$445M Motorola Acquisitions Shows Growing Public Safety Market

by Pat Nolan |1/14/2019

First responder mobility in the year ahead

Chicago-based Motorola Solutions, a leading provider of technological products for government, public safety and first responder agencies, has acquired VaaS International Holdings for $445 million. VaaS (video analysis-as-a-service) is a global forerunner in AI-driven image capture and data analysis technology best known for its automated license place recognition (ALPR) technology. The company also focuses on facial recognition, ballistic analysis, firearm mapping, body camera technology, and vehicle location data services.

This substantial investment by Motorola Solutions provides a basis for two predictions about the state of public safety mobility in 2019. One promises opportunity for vendors and solution providers in first responder and public safety markets. The other consequently expects end user organizations in these sectors to be overwhelmed by their digitally transformed workflows – there will be a required, collaborative learning curve.

Regarding opportunity, the $445 million purchase by Motorola Solutions (which was preceded by a roughly $1 billion acquisition of video-surveillance equipment and software company Avigilion last year) shows confidence that public safety and first responder organizations intend to spend big on technology upgrades in the near future – it is a market poised for growth. VaaS Holdings alone is expected to hit 2019 revenues of about $100 million.

About the purchase, one leading member of Motorola Solutions’ executive team says “with this acquisition, VaaS will expand our command center software portfolio with the largest shareable database of vehicle location information that can help shorten response times and improve the speed and accuracy of investigations.” The move also captures Motorola’s intention to expand its software and services business overall. Offering solutions that make sense of and extract value from masses of data has become a competitive requirement across platform types and vertical markets.

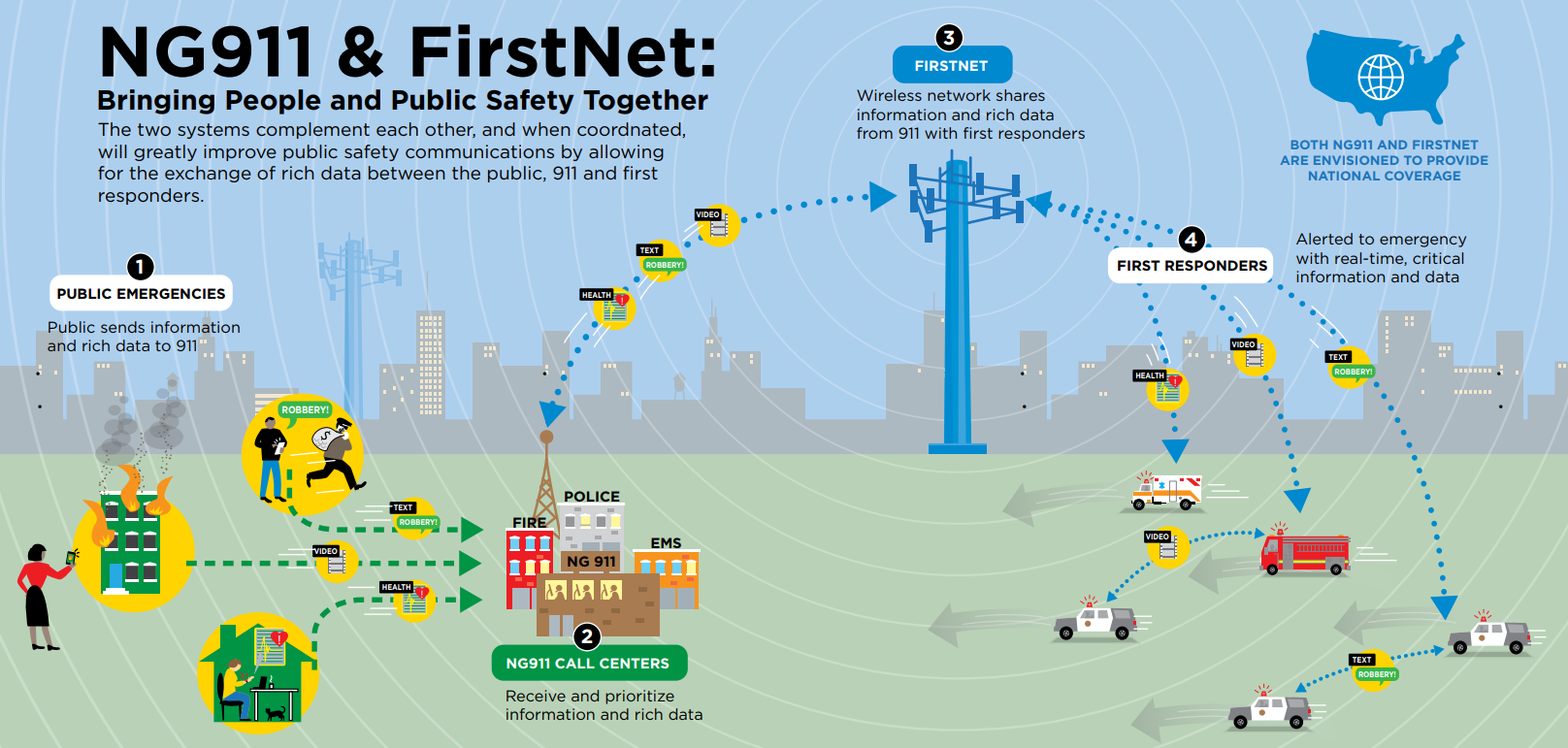

To bet on increased technology and mobility demand in these markets is not off base. Two major enablers on the public side, at least in the U.S., will be Next Generation 911 (NG911) and The First Responder Network Authority (FirstNet), the former being an IP-based 911 system to replace the existing analog 911 infrastructure and the latter being a dedicated nationwide broadband network for first responders. In late 2018, the National Association of State 911 Administrators (NASNA) released that NG911 was in at least the planning phase across the country, although deployment timelines are localized and disparate. Only a handful of states have NG911 implementation in progress, and fewer still have the new system currently implemented at state or sub-state levels.

On the other hand, AT&T, on contract to build FirstNet, claimed in December 2018 that they were six months ahead of schedule – the network went live in 2018, is one-third complete, will have 50% greater capacity by the end of 2019 and be in a position to smoothly transition to 5G. Key stakeholders of the FirstNet project are expected to discuss even more developments all week at CES 2019. Both FirstNet and NG911 will drastically increase the feasibility and usability of mobility investments among first responder and public safety agencies as they come to fruition.

Figure 1: Outline of NG911 & FirstNet in Practice

Source: NG911 & FirstNet – A Guide for State & Local Authorities 2nd Edition, NASNA

Along with the technologically forward-thinking movement among decision makers in these markets, there will undoubtedly be one consequential barrier to meaningful deployments – public safety and first responder organizations will aggregate more data than they will initially know what to do with. The bottom-line functionality of a majority of innovations targeting these sectors is to collect a massive volume of data. Think, for instance, of the immense amount of video captured by VaaS International Holding’s law enforcement body cam and automatic license plate recognition technologies. This anticipated problem is certainly why companies like Motorola Solutions and VaaS are developing and investing in software that helps effectively analyze the overwhelming inflow of information.

Still, end user organizations are expected to undergo an initial adjustment period in which the capabilities of new technologies far exceed how effectively they are leveraged. Likewise, the rate at which early adopters show proven business cases will affect how quickly budgets are properly allocated for related solutions.

Reflected in Track 5 of our 2019 research agenda, Voice of the First Responder, the Enterprise Mobility & Connected Devices team at VDC Research will prioritize public safety and first responder developments in the year ahead. We will follow along with and analyze the impact of public sector initiatives such as NG911 and FirstNet, related application and device developments from vendors and solution providers such as Motorola Solutions, and the effects of both on end user mobility. Download our 2019 Research Outline now to see the reports we have planned for Track 5 and otherwise in the year to come!