Enterprise Mobility & the Connected Worker Blog

Android Migration at the Heart of Forklift Mounted Computer Growth

by Pat Nolan |06/10/2019

Android’s footprint in the enterprise is a substantial and fast-growing one. VDC Research reports that in fiscal year 2019, shipments of rugged handheld computers running Android will surpass the sum shipment volume of all other operating systems for this small form factor. Google’s mobile OS is most significantly present in the rugged handheld category, but its rugged tablet rise is also notable; Android will account for 13.9% of that market in 2019, up from 10.9% in 2017. Still, the platform’s highest potential form factor, in terms of growth rate, is the forklift computer.

Android-based forklift computer demand spans fixed units and mountable tablets

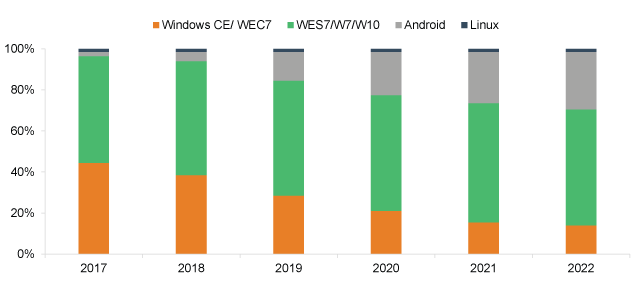

Although the overall market for forklift computers is much smaller than that of enterprise tablets or mobile handhelds, the Android opportunity for this niche of vehicle mounted units (VMUs) is worth attention as per VDC’s upcoming 2019 Forklift Mounted Computers Report. While Android-based tablet and handheld shipments are predicted to grow at compound annual growth rates (CAGRs) of 19.9% and 28.1% respectively during the forecast period 2017-2022, shipments for fixed forklift computers running the mobile OS in that time will grow at a 69.6% CAGR. Furthermore, there is a booming role of tablets in the forklift – in place of long-dominant fixed units – in which demand heavily favors Android. The unit volume growth of rugged tablets used for forklift applications, at a 19.0% CAGR in the given timeframe, far outpaces the forecasted growth rate of rugged tablets overall (4.8%).

Track 2, Topic 2: Forklift Mounted Computers, VDC Research 2019

The Android factor is especially important for vendors and solution providers targeting forklift applications because the overall market for forklift VMUs has a stagnant near future outlook. By revenues, fixed forklift computer shipments will gradually decline from $167.7M in 2017 to $163.3M in 2022 at a CAGR of -0.5%. Legacy Windows systems will contribute to a massive drop in revenues and newer Windows options’ growth is a crawl – the primary area of opportunity for purpose-built forklift units is Android. The prospects for tablets are more hopeful and evenly distributed among OS options and the form factor represents a major forklift market opportunity in itself, but the OS split here leans to the benefit of Android nonetheless; Windows forklift tablet shipments will grow at a 16.0% CAGR, Android at 36.2%.

An evolving forklift application landscape gives way to a massive OS migration

Android evangelists in the vendor community that targets forklift solutions are largely responsible for the niche market’s migration. Forklift VMUs have somewhat lagged behind other rugged form factors in terms of Android adoption, partly because these traditionally larger (~11.6 inch display) fixed units do not necessarily require a mobile OS and partly because warehousing operations fall behind other verticals in their mobile solutions innovation. However, as WMS developers continually expand Android options and relevant rugged hardware vendors follow suite, end user embrace of the OS in forklift environments has and will continue to naturally adapt.

Regarding forklift computer OEMs, Zebra Technologies released its Android-ready VC80x fixed forklift VMU in early 2018 and competitors such as Honeywell, JLT Mobile Computers, Glacier and Datalogic have likewise updated their forklift portfolios to support the OS within the last year and half or so. JLT Mobile’s fixed JLT6012 unit, which runs Android (in addition to Windows 10 and Linux), is in fact the company’s most successful, fastest-ramping product introduction to date. This general availability of Android solutions feeds into other strategic priorities of end users.

According to industry stakeholders interviewed for VDC’s 2019 Forklift Mounted Computers Report, cross-enterprise ERP standardization is a top concern for forklift solutions customers; it is much easier and more cost-effective for the IT department responsible for a warehouse’s or port’s mobile fleet to manage a unified computing environment across its organization. As Android has become a progressively more prominent legacy Windows replacement and greenfield opportunity winner in the rugged mobility space for tablets, handhelds and other mobile devices, the pursuit of platform consistency has brought that demand to forklift VMUs in spite of the form factor’s feasibility on standard PC operating systems such as Windows 10.

Android certainly will not do away with Windows in the forklift, but the former’s demand and subsequent growth is poised for greater acceleration than the latter’s. One OEM in this space claims that about 20% of new customer inquiries are for Android, and that that number is quickly growing. Another describes that just within the first half of 2019, conversation around and demand for Android among their customers has become noticeably louder. To learn more about the technology trends, adoption drivers and competitive landscape impacting the forklift mounted computing market in 2019, connect with the Enterprise Mobility & Connected Devices practice at VDC Research and look out for our soon-to-publish report dedicated to these very topics.