AutoID & Data Capture Blog

Eliminating Friction from the Retail Point of Sale

by Summer Schuster, with Andy Adelson | 07/09/2019

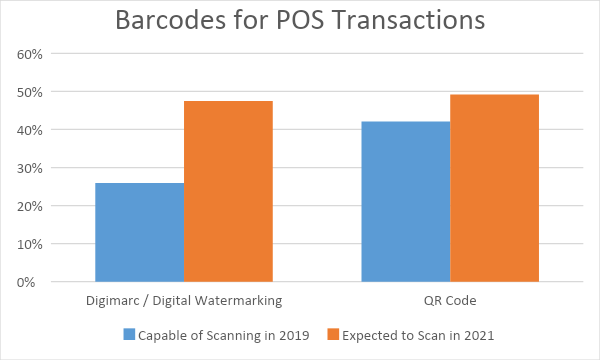

Change is afoot and the pressures facing retailers are driving them to re-evaluate their infrastructure, especially with their point-of-sale (POS) solutions. Taking stock of their operations, many retailers are moving towards administering new types of code onto their consumer products. These barcode technologies— able to surpass human visual abilities— can reduce rates of theft, decrease checkout scanning errors, and better monitor and scale each unique feature of a product. Three prominent scanning options at the checkout counter are Digimarc Watermarking, Quick Response (QR), and Digital Image Recognition.

VDC Research reports approximately 28% of retailers were extremely familiar with Digimarc’s Invisible Barcode—citing that the faster throughput at checkout and the improved packaging design were the primary benefits for applying this particular scan to items at the POS. This new form of labeling means that price, article number and other important variables can be captured instantly through camera scanners and some special software. Not only is this “invisible barcode” more effective at empowering merchants to participate in dynamic pricing, but also allows for a greater level of transparency between the consumer and the firm—thus lowering the transaction costs associated with the purchase. Digimarc accomplishes this by allowing factors about the product—such as nutritional information, and customer reviews— to be readily accessible through mobile devices. The biggest challenge with Digimarc, however, is that for its benefits to be fully realized at the POS, all items would need to be encoded: a factor that can be quite expensive to apply given the need for new image-based scanners to process the codes.

VDC Research reports approximately 28% of retailers were extremely familiar with Digimarc’s Invisible Barcode—citing that the faster throughput at checkout and the improved packaging design were the primary benefits for applying this particular scan to items at the POS. This new form of labeling means that price, article number and other important variables can be captured instantly through camera scanners and some special software. Not only is this “invisible barcode” more effective at empowering merchants to participate in dynamic pricing, but also allows for a greater level of transparency between the consumer and the firm—thus lowering the transaction costs associated with the purchase. Digimarc accomplishes this by allowing factors about the product—such as nutritional information, and customer reviews— to be readily accessible through mobile devices. The biggest challenge with Digimarc, however, is that for its benefits to be fully realized at the POS, all items would need to be encoded: a factor that can be quite expensive to apply given the need for new image-based scanners to process the codes.

QR Codes are also expected to grow within the ensuing years. A Matrix 2D symbology able to encode thousands of characters in a single symbol, QR Codes have become especially prevalent in mobile payment systems. A standardized approach seen in apps like WeChat and Alipay, QR Codes have opened markets in countries where access to traditional banking is limited, granted financial empowerment to both merchants and consumers alike in the payment process, and allowed consumers to review rates and potential deals in real time on any device. Although traditional barcodes are much more simplistic—both easier to read and make— the QR code is able to leverage the power of mobile phones and form a direct relationship with the business’s customers. A virtual punch-card able to measure the frequency and “loyalty” of each client, the QR Code allows businesses to be highly CRM-focused and relay a substantial amount of information back to the consumer.

Computer Vision (Digital Image Recognition) is expected to also move to the forefront of POS technologies by the year 2021. Enabling retailers the opportunity to not only engage in a cashierless store, but also the ability to identify items with pictures rather than barcodes—this ‘grab-and-go’ technology can reduce inventory losses, automatically capture audits on price tags, and notify attendants of all suspicious activities that may occur in-store. Ideally this technology would be able to remove human intervention—and subsequently remove human error—from the customer shopping experience. Using a combination of real-time analytics and cameras, Digital Image Recognition frees workers from the mundane and outdated operational process of tracking and manually ensuring complete compliance with all merchandizing standards and safety regulations.

In all, the race to create a seamless and efficient scanning process is well underway. Facilitating an easy checkout process is pivotal to both the shopping experience of the customer and the job satisfaction of the cashiers. Fueled by advancements in computer processing and mass storage device capacity, the ease of using these scans followed by the reduced labor costs associated with adoption, has pushed over 54% of retailers— primarily grocery stores and mass merchants— to explore new means of POS scanning solutions – including tunnel scanning configurations prevalent in high speed package sortation facilities. VDC Research has found that consumer expectations are pressuring retailers to drive change to their operations - in particular the POS process – and to how they digitally engage with customers.

View the 2019 AutoID & Data Capture Research Outline to learn more.