IoT & Embedded Technology Blog

IoT Application Platforms – What Company Will Take the Next Bite?

Few areas of technology or business can match the current levels of interest and anticipation surrounding the internet of things (IoT). Embedded engineering organizations and enterprises alike are struggling to keep pace with the expected rate of IoT change. They are rapidly modifying their business plans to pursue new service revenue opportunities enabled by the IoT. But challenges from tighter time-to-market windows and project requirements that extend far beyond existing internal skill sets is yet again recasting the traditional software build-versus-buy calculation. More organizations now recognize the need for new third-party development and management platforms to help them jumpstart IoT application creation and monetization.

VDC Research initiated coverage of this dynamic segment with the recent publication of the IoT Application Development and Deployment Platform (ADDP) market report. The executive summary is available here. We forecast revenue from IoT ADDP solutions is forecast to expand at over 40% compound annual growth rate (CAGR) through 2016. As one might expect, this pace of revenue growth in the ADDP segment and the IoT at large has drawn the attention of larger software and system solution providers.

As part of PTC’s strategy to supply “closed-loop lifecycle management” for systems engineering, the company bought two of the leading ADDP suppliers. (See more on this strategy here) PTC acquired ThingWorx in December 2013 and Axeda in August 2014. In March 2015, IBM announced plans to invest $3 billion in a new 'Internet of Things' unit over the next four years. But the Amazon acquisition of 2lemetry, also in March 2015, demonstrates that interest in entering this sector is not be limited to organizations currently competing in the ALM or PLM solutions market.

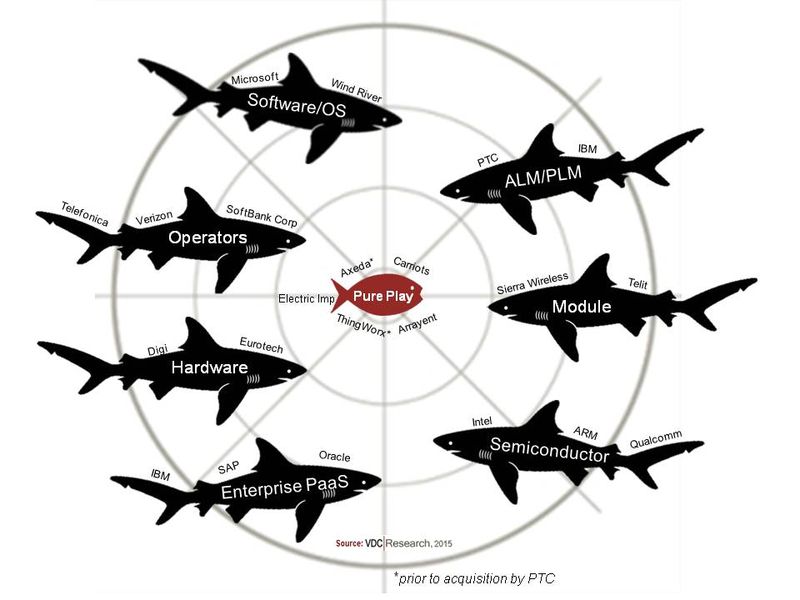

As the IoT matures, more embedded devices and back-end enterprise systems will continue to be linked together over communication networks in order to provide differentiating and lucrative services. Companies viewing the rapidly expanding ADDP opportunity as an adjacent market will come from broad range of segments including providers of operating systems, semiconductors, telecommunication networks, computing hardware/modules, enterprise back-end systems, and other software solutions. Independent providers of IoT application platforms should plan for new competitors and potential suitors from a number of domains.

Stay tuned, we expect that more companies with deep pockets and expansive sales distribution will likely follow the lead of Amazon and PTC by entering the ADDP segment via acquisition in the next few years.

For more information, we invite you inquire about our research and download the executive summary of our IoT Application Development and Deployment Platform; it is available here.