IoT & Embedded Technology Blog

Security is Microsoft’s Silver Bullet to Battle AWS

by Roy Murdock | 10/02/2018

Microsoft and Amazon are locked in a battle to shape the future of computing with their cloud services platforms. Both companies are building out global networks of datacenters and enticing customers to purchase compute-as-a-service as a more flexible alternative to maintaining and scaling infrastructure in-house. Other large software and industrial players – GE, Google, IBM, Oracle, PTC, etc. – have joined the cloud services fray, but when it comes to horizontal IoT cloud services, Microsoft and Amazon are strategic leaders and industry trendsetters.

Recent large IoT wins for Microsoft include a new, potentially massive partnership with Volkswagen, while AWS has pushed out a plethora of Alexa-integrated devices across smart home and automotive systems.

AWS and Microsoft are both horizontal-focused players by nature of their size and market presence – they are focused on expanding globally, and expanding the breadth of options available to customers and partners, rather than drilling down into one industry or vertical. Both companies are putting pieces of the software stack in place to battle for IoT market share.

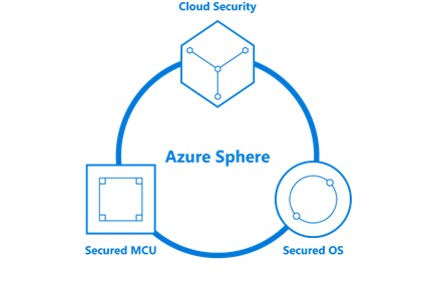

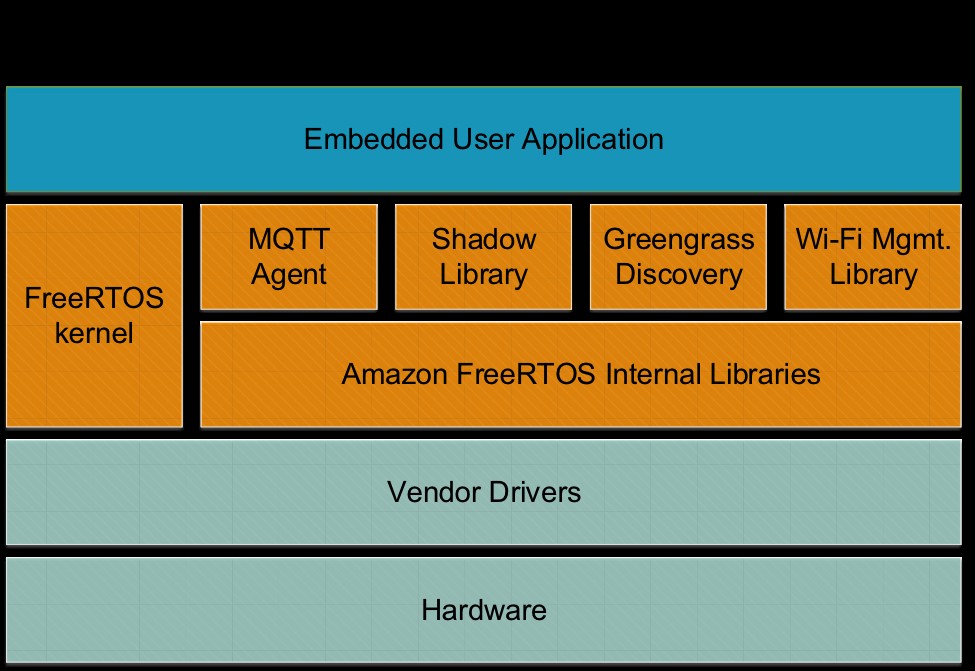

The latest battleground between these two behemoths, and the one of most importance to embedded device makers, integrators, and OEMs, is at the Operating System (OS) level. Amazon acquired FreeRTOS in November 2017, an MCU-focused OS that ships into hundreds of millions of MCUs yearly. Microsoft countered in April 2018 with Azure Sphere, a Linux-based 3-core SoC built around SphereOS, a custom Linux derivative developed by Microsoft (the second-ever Unix-like OS developed by MS). Notably, both are championing open source OS solutions for the IoT market, placing potential long-term cloud services adoption over up-front software licensing revenue. Both companies are foregoing OS revenue to get data streams connected to their platforms without friction, instead capturing cloud services revenue.

As both IoT services giants move further out of general-purpose device classes such as gateways, and beyond non-safety-critical verticals such as smart home systems, comprehensive security will be a crucial selling point. Microsoft is acting early to provide the market a nearly turn-key solution, and to establish itself as a leader in the secure IoT space. This strategy should pay dividends as the backlog of insecuresystems continues to interface with an increasing number of networks and attack vectors.

AWS has been largely content to keep AWS FreeRTOS much the same since its acquisition, staying the course with its strategy of shipping into low-footprint MCU devices and providing an easy connection to the AWS IoT cloud services platform. Microsoft’s strategy to deprecate its Windows Embedded portfolio in favor of the combination of SphereOS and Windows 10 IoT is prescient, and will be a key differentiator for Microsoft’s overall Azure IoT portfolio.

AWS currently has the advantage in the market for MCU-class devices due to the legacy footprint of FreeRTOS, which has been under development for over 15 years. But for a growing number of lucrative IoT projects, security is paramount. AWS can rely on WITTENSTEIN for board and functional safety support, but will need a compelling answer to Microsoft’s newfound focus on security. AWS could answer Microsoft with an IoT-focused Linux derivative of its own, but the company now has fewer options to differentiate against Microsoft from a horizontal perspective – security is the big one, and Microsoft is working extremely hard to stake its claim in what could be its “silver bullet” for its IoT portfolio, at the OS level.

This strategy was quite apparent in discussions with IoT product managers at Microsoft’s Ignite Conference last week. CEO Satya Nadella also emphasized the changing nature of the company’s strategy. He spent the first half minutes of his keynote highlighting the IoT work Microsoft is doing with industrial organizations such as Royal Dutch, Buhler Group, and BMW, as opposed to the traditional IT and enterprise organizations using Office 365 and similar business products. He returned to highlight the importance of SphereOS at the end of his speech – an idea almost unthinkable under the Windows-dominated Microsoft of the past.

.@satyanadella promoting @Azure SphereOS as solution for 9 billion MCUs shipped into #IoT yearly - no mention of @Windows. Focus is clearly to use @Azure as new computing platform for heterogeneous (non enterprise) systems pic.twitter.com/OYpKz9rHuK

— Roy Murdock (@RoyMurdock) September 24, 2018

The focus at Ignite was clear – security for IoT, and how Microsoft is positioned to bring data together for a new generation of “AI-enabled” devices and systems.

We discuss these topics in-depth, and include quantitative market sizing and engineer data in our reports: IoT Cloud Platforms-as-a-Services and IoT & Embedded Operating Systems.