IoT & Embedded Technology Blog

AMD-Xilinx Becomes New Market Leader for Embedded System-on-Chips

2020 has been a year of tremendous change for most everyone including the global market for IoT, embedded and mobile processing solutions. Earlier this week, AMD announced it had entered into a definitive agreement to acquire Xilinx in an all-stock transaction valued at $35B – just below the record-setting acquisition of Arm by NVIDIA for $40B announced just over a month ago. Xilinx is the market share leader for embedded FPGAs and the combined AMD-Xilinx organization would become the new market share leader for SoCs. The combination of AMD’s portfolio of MPUs, GPUs, and SoCs with Xilinx FPGAs and FPGA SoCs creates many opportunities for the combined entity to support a wide variety of evolving workloads and system/infrastructure footprints in the cloud, edge, or end devices.

|

AMD’s press release announcing the planned acquisition highlights how the addition of Xilinx expands its growing data center business and total available market with adaptive computing solutions. In fact, the overlap between AMD and Xilinx in terms of target industry applications and systems types is minimal. Xilinx brings in considerable support for high-performance applications and functional safety standards beyond AMD’s focus in areas like aerospace, automotive, defense, and healthcare while augmenting the company’s current solutions targeting communications, networking, and industrial infrastructure.

The move is reminiscent of when the leading embedded MPU provider, Intel, acquired Altera five years ago in an all-cash transaction valued at $16.7B to extend its silicon flexibility and support into new markets and embedded applications. In fact, FPGAs have been recognized over the past several years as being extremely valuable to workload acceleration and distributed high-performance computing. A few years after the Intel-Altera acquisition, Microsemi was purchased by Microchip for $8.3B. The last remaining big vendor of discrete FPGAs, Lattice Semiconductor, would also already be under different ownership right now if its acquisition by Canyon Bridge Capital Partners was not blocked by the U.S. government in late 2017 on the grounds of national security. Having access to the leading FPGA provider’s IP and SMEs can be a powerful tool for AMD to challenge more high-performance embedded computing market opportunities.

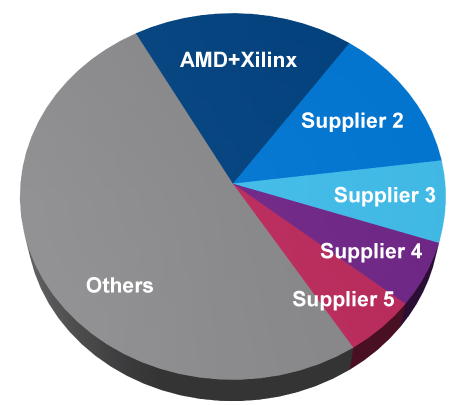

We believe the acquisition will push AMD further into the Arm ecosystem and away from x86 for MPU architectures on future embedded offerings if NVIDIA keeps its promise to maintain Arm’s open licensing business model (as it should). Xilinx is one of the largest Arm partners, particularly for the high-performance segment. In addition, Intel has just become an even larger direct competitor to AMD as they now compete with each other in the FPGA market where both companies (Intel FPGA and Xilinx) together make up more than 75% of discrete FPGA global market revenues. Nonetheless, the acquisition of Xilinx is just the high-stakes ammo that AMD needed to reignite its prospects for supporting a wide range of emerging high-value workloads spanning 5G, AI, autonomous vehicles, machine vision, and others. An adaptive computing portfolio is just what AMD needs to expand from its traditional strongholds in embedded processing with comprehensive support for all of the leading types of semiconductors in the market today.

To learn more about our research coverage on the global market for IoT, Embedded & Mobile Processors, click here.