Enterprise Mobility & the Connected Worker Blog

The Rise of the Rugged Enterprise Smartphone

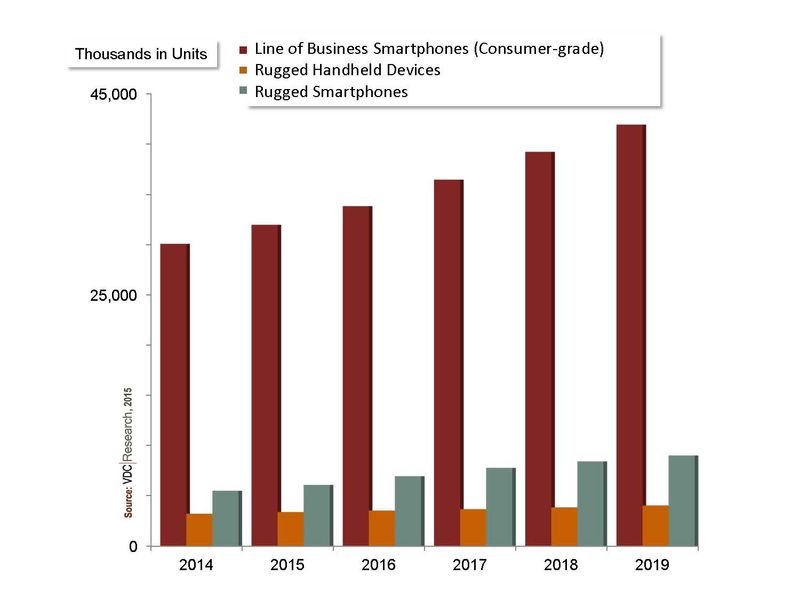

Smaller form factor devices—namely rugged handheld computers and smartphones—remain among the most common device types that support line-of-business (LOB) workers across nearly all industry verticals. VDC estimates that manufacturers will deploy a total of 3.4 million rugged handheld computers and 32 million smartphones in 2015. While there is some overlap between use cases for rugged handheld devices and for smartphones, the latter are more aligned with highly business- and mission-critical applications, which place a premium on reliability and have unique data capture requirements. However, the rugged smartphone has emerged as a new form factor in recent years. These devices are similar in design and user experience to the consumer-grade smartphone, but they feature enterprise-grade levels of ruggedness and improved daylight readability. The rugged smartphone caters to end-users who want a more ergonomic and touch-centric device with integrated data collection options.

Green field opportunities for an emerging device category

Despite concerns of erosion from consumer-grade devices and the recent but strong emergence of the rugged smartphone into the marketplace, VDC believes the new form factor will serve primarily as a complement rather than replace the traditional “brick-style” rugged handhelds, which cater to a core group of end users for data collection-intensive applications in areas where data entry via touchscreen remains impractical.

The rugged market, despite its recent return to growth and inclusion of the rugged smartphone, will face numerous challenges ranging from shifts in consumer demands to macroeconomic trends. While the Americas remain the primary engine for growth throughout 2015 and onward, this growth will largely be overshadowed by a weakening European market that has been exacerbated by Greece’s economic instability and a weakening euro that has dropped to historic lows in much of 2015. Additionally, the impending release of Windows 10 on rugged devices could see many companies opting to extend their replacement cycles, which could depress rugged handheld sales in 2016 and provide consumer-grade devices with additional opportunities to expand their enterprise presence.

Growing competition from consumer-grade manufacturers

The broader non-rugged or consumer smartphone opportunity in the enterprise is expected to exceed 200 million units, representing 14% of total smartphone shipments. The growing availability of peripherals and to augment the functionality of consumer devices and provide better protection are further opening the opportunity for consumer smartphones in the enterprise, especially for line of business applications. In addition, leading vendors such as Apple and Samsung are now actively targeting the enterprise, looking to develop new and higher value-adding opportunities, particularly as consumer sales have begun to peak. Their addition to the enterprise market has the potential to have a significant impact on how organizations choose to mobilize their workforce, affecting not only price sensitivity, but OS choice, application development, and replacement cycles.

View the 2017 Enterprise Mobility & Connected Devices Research Outline to learn more.