Enterprise Mobility & the Connected Worker Blog

Hip to be Enterprise: New Enterprise Focused Tablets Stealing the Show

With the broader tablet market in the midst of an identity crisis one segment receiving increased attention are enterprise end users. VDC’s recently published 2015 Enterprise and Government Tablet analysis confirms this opportunity, forecasting annual growth of enterprise tablets – which represent approximately 15% of the overall tablet market – at 12.1% annually through 2019. A flurry of new products targeting the enterprise user from mega-brands Apple and Microsoft and specialty rugged mobile vendors Zebra and Xplore are directing the spotlight on this segment.

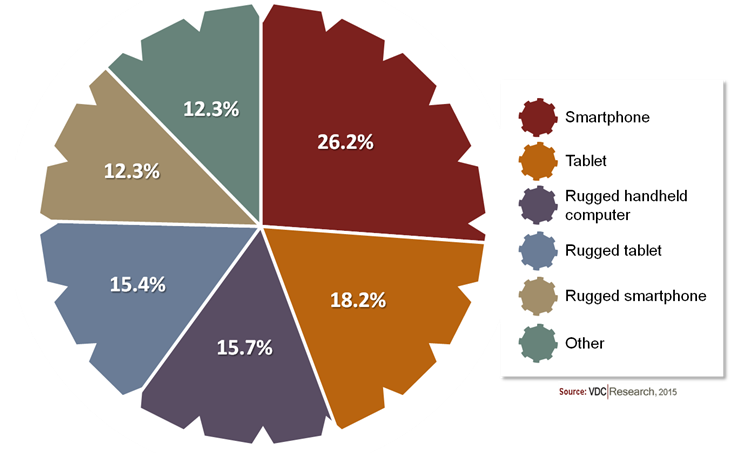

In comparison to other mobile form factors, tablets are an increasingly popular selection for enterprise line of business (LoB) applications. According to recent research conducted among enterprise mobility decision-makers, tablets are selected 33% of the time among devices issued to employees by enterprises in support of LoB applications. As the number of mobile deployments in LoB workflows continues to grow, consumer mobile devices are setting the benchmark for what any mobile device should look and feel like, resulting in the emergence of a new breed of enterprise tablets. Beyond enterprise-focused rugged OEMs, consumer-grade vendors are also turning their attention to the enterprise market through both their consumer portfolios and the introduction of more durable, enterprise-minded devices.

Enterprise Issued Mobile Devices Used to Support LoB Workflows by Form Factor

New Rugged Tablets from Zebra Technologies and Xplore Technologies

Zebra Technologies held its much anticipated Tablet Plus launch announcement on September 15 during which it unveiled the details of its new ET 50 and ET 55 tablet computers. As Zebra’s first new tablets to be released since the launch of the ET1 in 2011, notable features included support for both Windows 8.1 and Android Lollipop 5.1 in addition to Wi-Fi and/or LTE connectivity. Designed with a consumer feel and equipped for the enterprise, the tablets look to penetrate a still unsaturated enterprise tablet market. With a rugged design, comprehensive accessories to meet industry demands and unique scanning capabilities the ET 50 and ET 55 look to address a number of business use-cases, most notably those in the direct store delivery (DSD), field service, and retail verticals. However, a challenge for Zebra in our estimation will be aligning their tablets with the most appropriate use cases and target industries. Although tablets are being widely adopted in markets Zebra typically serves, these are mostly lower priced consumer devices. Demand for rugged tablets with the specifications and price points featured by Zebra’s new products is mostly concentrated in public safety, utilities, telecommunications and manufacturing environments, segments outside of Zebra’s traditional “sweetspot”. Another challenge, not uncommon in the rugged mobile market, will be the price points of the ET 50 and ET 55 which are $1,850 to $3,000, depending on the configuration. Although the benefits of rugged mobile devices are calculated by their lower failure rates, higher reliability and ultimately lower cost of ownership, even these target prices are high when compared to competitive rugged tablets.

Not to be outdone, Xplore Technologies unveiled the XSLATE B10, a fully rugged 10.1” tablet running Windows 8.1 (Windows 10 upgradeable), also on September 15th. The device is a fully featured tablet with multiple I/O and configuration options targeting field worker applications in transportation, manufacturing and telecommunications segments. Xplore has undergone some significant changes in 2015, none more impactful than its acquisition of Motion Computing’s assets in April. According to VDC’s most recent rugged mobile research, boosted by the Motion acquisition and strong performance of its existing business, Xplore was the leading rugged tablet supplier in Q2 2015. Now with the target on their back Xplore will need to provide staying power and consistency in performance – especially surrounding support services for its increasingly global customer base – in order to build on its recent successes.

Not the only new tablets in town

The Zebra and Xplore announcements comes on the heels of Apple’s release of the iPad Pro on September 9. The iPad Pro makes a stronger enterprise use-case argument as compared to Apple’s past consumer-focused tablets. Features including a large 12.9” display, the new A9X chip for increased speed and responsiveness and new iOS capabilities such as split screen viewing. In addition, accessories such as the new Apple Pencil and Smart Keyboard enable the device to more adequately serve end-users in corporate environments. Borrowing liberally from Microsoft’s playbook (which will be introducing the Surface Pro 4 in October), this device is Apple’s first foray into the rapidly growing 2-in-1 market. However, at the end of the day the iPad Pro is an iPad running iOS at a price point that makes it competitive with Apple’s MacBook Pro. While iOS9 does introduce some interesting features that make the platform more friendly to corporate users – for example, multi-tasking and app management including app-specific VPN management – it cannot be considered an enterprise alternative to Microsoft’s Surface Pro or other 2-in1s powered by big OS/x86 architectures.

The enterprise limitations of the iPad Pro when compared with PCs is clear including the lack of file management capabilities and scripting technologies designed for PCs, compatibility with most productivity applications, lack of AD support and limited I/O options to name a few. At the end of the day this is just another, somewhat larger, iPad, albeit with a high end active stylus (pencil) at a higher price point. While one could argue a future where iOS or other lightweight OSes become the enterprise OS of choice and laptops are promoted to the same architecture and framework as the rest of the mobile eco-system, that is a generational change and not one just around the corner. That said, Apple is not standing still and is clearly serious about the enterprise opportunity. Initiatives with IBM and Cisco are breaking enemy barriers and compelling use cases for iOS devices (especially tablets) are being created, often transforming existing workflows. However, even with all of these enhancements, the iPad Pro is not a general purpose PC and cannot be considered a direct competitor to other two in one products like the Microsoft Surface Pro. Therefore we do expect Apple to encounter a bit of a positioning dilemma with the iPad Pro relative to existing iPads, 2-in1s and its own MacBooks.

What Makes a Tablet Enterprise Friendly?

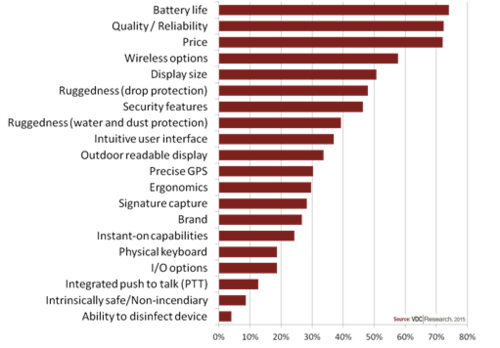

According to a recent survey fielded by VDC Research among over 650 enterprise mobility decision makers, when evaluating mobile devices for line of business applications, battery life ranked predictably high on the list as did price and overall quality and reliability. With many of these tablets used in the field, wireless options—including embedded cellular capabilities—are critical (one key pain point for many enterprise and government tablet deployments has been sub-optimal GPS quality). In addition, overall ruggedness of the device—in terms of drop and water/dust protection—are key decision criteria for many applications. Surprisingly, however, security features such as integrated biometric capabilities did not crack the top five in overall importance.

However, tablets are often best characterized as a marriage of compromises. Therefore, for many enterprise line of business applications, of equal importance is the accessory and peripheral eco-systems developed by tablet OEMs and their partners. According to our research, protective cases lead the list of accessory requirements, in addition to solutions like payment and scanning sleds, multi-bay charging docks and vehicle mounts. In addition, highly application specific functionality, such as Zebra’s wireless DEX Bluetooth FOB (which addresses the huge headache and point of failure of cabled DEX solutions in the Direct Store Delivery market) often represent the keys to a well designed mobile solution.

Mobile Device Requirements for Devices Supporting LoB Applications

The tablet form factor has unique appeal for mobile workers supporting a variety of enterprise and government workflows and applications. While the overall tablet is going through its most recent identity crisis, opportunities for business and public sector applications remain strong and robust annual unit growth (for both rugged and non-rugged tablets) is projected by VDC through 2019. The tablet form factor addresses mobile workers’ need for a portable mobile device while providing sufficient display real estate to support meaningful applications. From forms-based inspection and data collection applications to using the tablet as a customer engagement tool in high value retail environments, the opportunities for these devices are substantial.