Enterprise Mobility & the Connected Worker Blog

Q2 2016 Rugged Mobile Hardware Market Overview

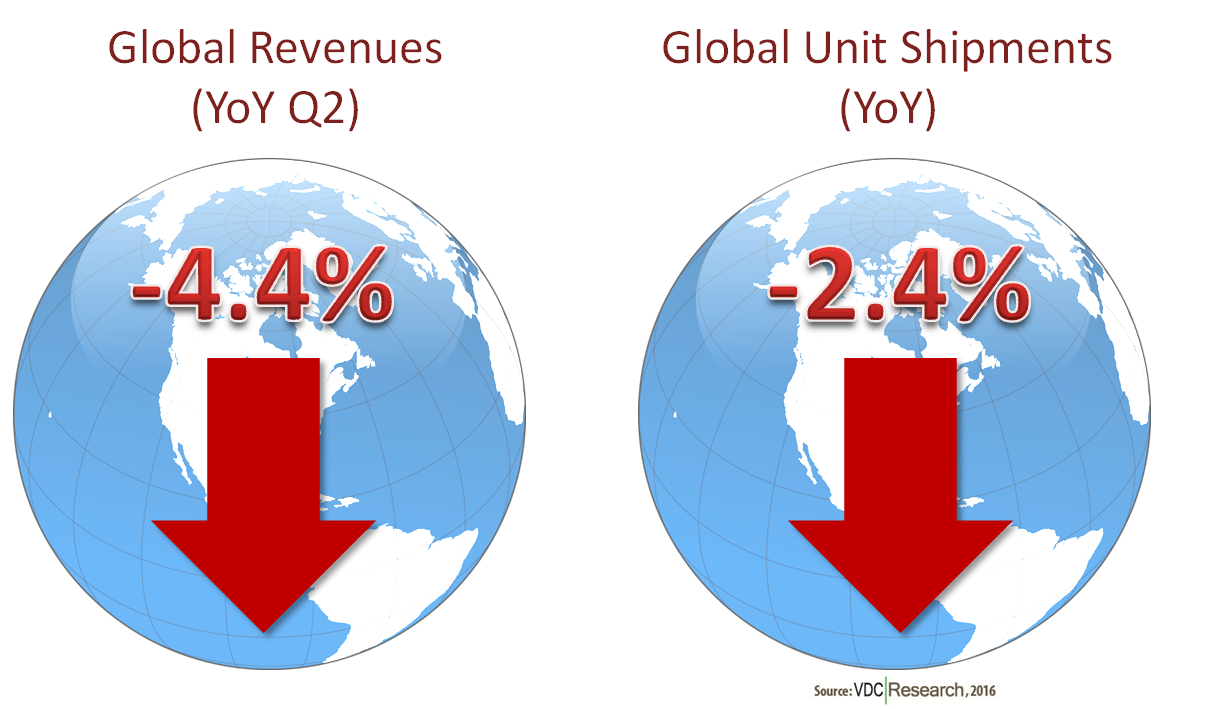

In Q2 of 2016, the total worldwide rugged mobile hardware market, sized as all rugged notebooks, tablets, forklift mounted devices, and handhelds, grossed nearly $958M in revenue shipments and had over 1,033,000 units ship. As seen in Figure 1, the Q2 rugged market saw an overall year-over-year (YoY) revenue dip of 4.4% when compared with Q2 2015.

Figure 1: Rugged Mobile Hardware Global Overview

The rugged market continued to struggle in Q2, with overall YoY revenues remaining at sub-$1B levels for the second consecutive quarter. Looking at this YoY comparison, there was weakened global revenue shipments for handheld/PDA computing devices and forklift mounted computers. In contrast, the rugged notebook and tablet markets experienced YoY global growth.

Breaking Q2 2016 down by region and form factor, we notice the Americas region experienced significant revenue losses in the handheld device space over Q2 2015. Similar to last quarter, these losses are primarily due to large Q2 2015 contracts and subsequent deployments. Furthermore, Latin America’s economic and political climate has caused some organizations to re-evaluate or push out deployments. Handheld devices in EMEA and APAC continued to experience growth this quarter, albeit minor, posting small gains over Q2 2015 reporting’s. Interestingly, VDC notes that Android operating systems exceeded 20.0% of all OS shipments in the first half of 2016, with Windows Legacy platforms still accounting for roughly 68.0% of all rugged handheld shipments.

Tablets saw modest growth this Q2, with Americas and APAC rebounding over Q1 and posting revenue gains when compared to Q2 2015. With that said, EMEA experienced stagnation and saw a minor contraction YoY compared against Q2 2015. As screen real-estate becomes more and more important, vendors are generally trending towards larger display sizes. Interest in the 10” and 12” space continues to grow, especially within the semi-rugged category of devices due to their weight difference compared with heavier fully rugged devices. These larger semi-rugged tablets would often be placed head-to-head in competition with many consumer grade tablets in industries which are heavily client/customer facing (i.e. hospitality, retail, and transportation are prime targets given their non-hazardous contexts). Additionally, interest in smaller 7”- 8” tablets is also growing for the fully rugged classification. These smaller tablets are often used in automotive or flight-line mechanical inspection contexts.

The rugged notebook space saw its second consecutive quarter of growth, experiencing YoY growth in two out of three regions. Specifically, EMEA posted the highest increase in revenues, with APAC also experiencing a revenue bump compared with Q2 of 2015. In contrast, the Americas region experienced contraction over Q2 2015. The rugged notebook market is continues to benefit from increased channel stability coupled with increased demand for Windows 10 upgrades and should see these benefits continue to drive revenues upward for the second half of 2016.

For more information, be sure to review our full (Q2 mobile hardware tracker and database), released at the end of September.