Enterprise Mobility & the Connected Worker Blog

AT&T Awarded FirstNet Contract

Next Steps Critical as AT&T Manages High Expectations and Rivada’s Aggressive Pursuit of States to Opt Out

By Nick Elia

Overview of Contract

AT&T has recently been awarded a multi-billion dollar contract over a 25 year period to maintain and install FirstNet, the first responder safety network originally created by the 911 commission. The contract value is totaled at around $46.5 billion, with AT&T contributing 40$ billion and the government contributing $6.5 billion through the FCC’s AWS – 3 Spectrum auction proceeds. The contract will create 10,000 jobs over the first 2 years, and will require AT&T to access over 40,000 towers in the U.S increasing their tower activity significantly since 2014. AT&T will gain access to 20 MHz of the 700 MHz spectrum and the government contribution of $6.5 billion so they can begin designing and rolling out the network nationwide. FirstNet will be given the highest priority to use the networks spectrum for emergency communications, and public safety personnel can use the network to make mission critical calls, transfer data, messages, images, and videos when the network gets overloaded during a nationwide crisis. AT&T will have to adhere to a tight build timeframe and are expected to achieve 60% coverage within the first 2 years and 80% coverage within 3 years. The expectation is that 20 of the largest municipalities will receive coverage within the first 12 months. However, even with the best laid coverage plans, the economic realities of this network will result in coverage gaps, in particular in rural areas. The current expectations for FirstNet are dangerously high. Moving forward, it will be extremely important for AT&T to manage these and ground these expectations.

The overall effort is unprecedented as no such network exists today. The is no blueprint and therefore it is important to view this more as an evolution. In recognizing this, AT&T is also looking to make a potential transition as seamless as possible. A key factor in AT&T’s proposal was that on the day after a state elects to “opt in”. AT&T will provide access to its commercial network that operates on 150MHz of spectrum across various bands to public safety and – most critically – will provide preemption for public safety users. This will be a key selling point to governors facing the “opt-in/out” decision. Public safety users will have preemptive priority access to all of AT&T’s commercial networks today and once Band 14 is built out will have preemptive priority access across commercial and Band 14 networks should a Band 14 cell be saturated.

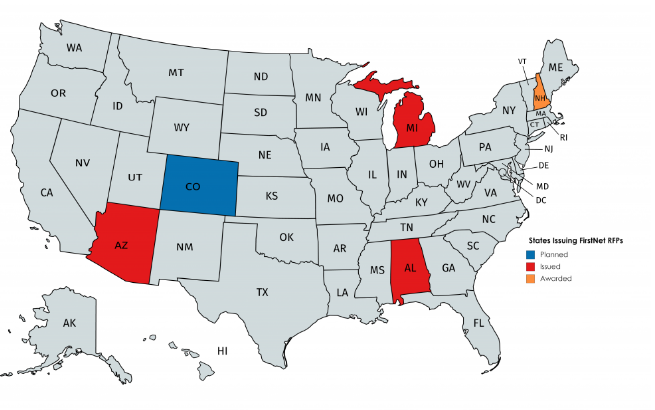

States Wishing to Opt Out

All 56 U.S States and territories will have the option to be a part of the FirstNet Program, but these states / territories will also have the option to create their own public safety networks if they do not wish to use the FirstNet plan. AT&T has 180 days to prepare state specific plans for the rolling out of FirstNet, and once the plan has been established these states then have 90 days to make a decision on opting out of FirstNet or not. Once a state decides to opt out of the plan, they have 180 days to issue an RFP (Request for Proposal) to the government for their Radio Access Network plan to be inspected and approved. The states alternative plan must follow the same guidelines as FirstNet, and must be interoperable within the network. Once the alternative plan is approved, that state is eligible to apply with the NTIA for a grant to fund the network. The funding will most likely be less than the FirstNet Program since the grant is only going towards the funding the Radio Access Network, and states have to apply for the grant within 60 days of their alternative plan being approved by the FCC. AT&T will not be able to receive spectrum funds from states that opt out, and we have already seen some states like NH moving in this direction with their announcement of using Rivada Networks as their provider instead of AT&T. The map below shows states broken down by undecided, those who have issued RFPs, those who have been awarded RFPs, and those who plan on issuing an RFP in the near future.

Advantages to FirstNet

- Ability to gain immediate access to a vast amount of public safety and federal agencies through a uniform commercial LTE infrastructure.

- Can extend this broadband service to more rural areas that didn’t have the communication coverage initially.

- Agencies can avoid negotiating with states/regions individually and go through FirstNet instead.

- Creation of small cell networks so tower traffic can be dumped on to local networks and free up more spectrum for higher priority FirstNet customers.

- Program requires full utilization of its assets to maximize the potential benefit from the network.

Disadvantages to FirstNet

- States who opt into the program will lose control of their spectrum assets and will limit their capabilities and actions outside of the FirstNet Program. In other words, states lose a lot of decision making power because these get transitioned to FirstNet.

- Possible loss of existing investments in public safety communications networks at the state and federal level. (Loss of assets already deployed in this area).

- Small communities may not be able to create financially sustainable programs so they will be forced to use FirstNet.

- States will lose their bargaining power when they negotiate for improved services because their fees represent a very small portion of FirstNet’s revenue stream.

- System wide failure / Cyberattack is always possible, monopoly pricing, poor management of program within that certain state.

Other Winners & Losers of FirstNet Contract

Rivada Mercury, LLC. – Loser

Rivada was one of the 3 original bidders of the FirstNet Contract along with AT&T and pdvWireless. They filed a lawsuit against the U.S gov’t after they claimed that they were wrongfully rejected during the procurement process to build the public safety broadband network for the U.S. In the 45 page report it stated, “Interior failed to make any reasoned or explicit determination that Rivada Mercury had no reasonable chance of being selected for award following discussions. In fact, Interior failed to conduct proper discussions as it was required to do. If Rivada Mercury had properly been allowed to remain in the competition, FirstNet, the Nation’s first responders who will eventually be using the NPSBN, and the taxpayer would benefit from the better value gained through robust competition.” The court eventually ruled against Rivada and their claims against the FirstNet Contract. They do plan on appealing the ruling and will aggressively attempt to attract “opt out” states that want to roll out their own plans. They have already locked in NH as a state that plans on setting up its own network. Rivada’s “trump card” in convincing other states to opt-out, is positioning the opt-in decision as one in that states cede all control of their Public Safety communications network to the Federal Government and will have little to no say in the network themselves. While this is not entirely true, it will be especially important for States opting in to be proactive participants to ensure that their requirements are heard.

Tower Companies / Sector - Winner

There is much anticipation that the tower sector and companies within the sector will benefit substantially from the FirstNet Contract. The sector in general has had a very lackluster performance the past couple of months and this contract will create more growth opportunities. Although it is still unclear which specific tower company stands to gain the most from the contract, companies like Crown Castle, American tower group, and SBA Communications have all been given favorable 1 year price targets. Now that AT&T has officially been awarded the FirstNet contract, it looks as though Crown Castle is in a very good position to gain the most revenue. AT&T struck a deal with Crown Castle back in 2013 for the acquisition of 9,700 towers for about $4.85 million. These towers represent a good portion of all of AT&Ts towers and they will more than likely be towers that AT&T accesses initially as part of the FirstNet contract. Looking at the program from a nationwide standpoint, if FirstNet is launched across 50,000 towers in the U.S. at a normal rate of 500$ a month, this will result in $230 million of incremental revenue for the big 3 tower companies.

Harris Corporation – Winner assuming AT&T includes them in their proposal

Harris Corporation stands to benefit from the FirstNet contract with AT&T since there is speculation that they will play a role in the infrastructure of the tower network. Harris was involved in all 3 original proposals, but had the most expanded role in the Rivada Mercury Consortium. It was smart of Harris Corporation to involve themselves in all 3 proposals rather than being exclusive to one specific party, this way they could ensure that their products/services would be needed for the contract regardless of who the prime contractor was. It is still unsure as to whether or not Harris will be able to complete a teaming agreement with AT&T to use their product/service offerings in the contract, but CTO Dennis Martinez is optimistic and believes that “AT&T are going to need the support from industry players, particularly those that have channels to market and have teams that can execute and implement public-safety projects.”

For more information about VDC’s coverage of Next Generation Public Safety Solutions, please download our 2017 Enterprise Mobility & Connected Devices Research Outline.