Enterprise Mobility & the Connected Worker Blog

5G Opportunities to Speed up Manufacturing’s Lagging Mobility Pace?

by Pat Nolan | 07/06/2018

The 3rd Generation Partnership Project (3GPP), a collaborative telecommunications standard development organization, has its final milestone on the road to universal 5G availability in sight. This is a road the collective is in part tasked to pave; it is 3GPP’s job to set the standards and specifications for 5G networks and technologies. The organization’s last step regarding 5G is its Release 16, which will expand on large-scale, ubiquitous IoT use cases for the most robust wireless network standard to date. Release 16’s full anticipated timeline spans between now and 2020.

Meanwhile, service providers are aggressively building out their 5G infrastructures in a race to be first to market, and hardware manufacturers are embracing a 5G future with a similar gusto. The 5th generation mobile wireless network, or 5G New Radio (NR) standard, promises to deliver on the higher speeds, lower latency, and diverse device support needed to fuel the future of mobility. With the impending reality of 5G and all it promises to offer, it is worthwhile to consider how it might affect one of its most likely beneficiaries and a mobile tech laggard, the manufacturing industry.

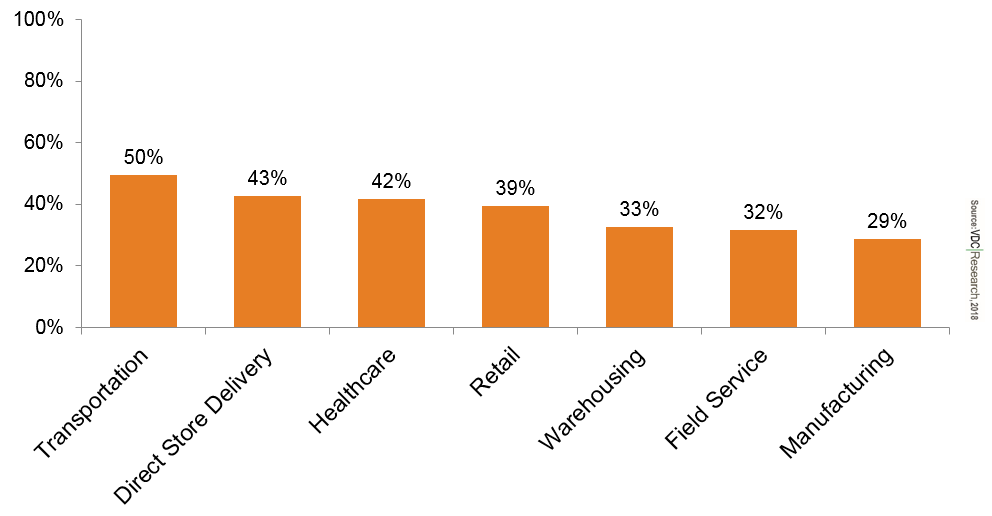

Manufacturing organizations are habitually slow adopters of mobile technologies; one of our most recent studies confirms that remains true this year. In our 2018 Enterprise Mobile Buyer Behavior Report, we find that only 28.8% of manufacturing operations have sufficient funding to address all of their mobile initiatives. This is the lowest across all seven industries covered in the study (Exhibit 1). Manufacturing ops were also the least likely to have a formal mobile technology policy in place (49.3%). One front on which these organizations do pioneer, however, is wearables. They currently deploy, or plan to deploy, smart watches and smart glasses more than any others.

Source: Enterprise Mobility Buyer Behavior Report, VDC Research 2018

The most heavily supported features for smart glasses in manufacturing are heads-up display and AR/VR. It is likely that 5G will be a catalyst for these use cases. 5G connectivity offers the high capacity, unmatched speed, and minimal latency that AR and VR demand to operate smoothly. Beyond wearables, 5G enables the entire factory to be digitized and enhanced with mobility. High-stakes industrial processes, which deal with hazardous environments and considerable safety and security demands, have traditionally relied on a wired connection to meet the required levels of performance. A dependable wireless network that is 5G would allow the large-scale introduction of remote motion controlled robotics, connected goods, IoT sensors, and autonomous machines that could facilitate unprecedented levels of visibility, efficiency, and safety in industrial processes.

In our 2018 Enterprise Mobile Buyer Behavior Report, we find that the top three inhibitors of mobile technology upgrades in manufacturing amount to a lack of resources. Do you think the promise of 5G will be enough to attract the attention, and funding, of key stakeholders in manufacturing organizations?

To learn more on the development of 5G as it relates to Industry 4.0, be sure to keep up with the 5G Alliance for Connected Industries and Automation (5G-ACIA), a group dedicated to that very cause.

More Info:

For more on the discussion of 5G opportunities in manufacturing, check out our upcoming VDC View: Exploring the State of 5G and its Industrial Opportunities. For extensive coverage of many other enterprise mobility trends, some of which are touched on in this blog, see VDC’s 2018 Enterprise Mobility Buyer Behavior Report based on our annual survey among mobile solution end users across healthcare, field service, warehousing, manufacturing, retail, transportation, and direct store delivery (DSD) operations. Learn more about the AR/VR market in our Global Market for Enterprise-Grade Wearables report.