Enterprise Mobility & the Connected Worker Blog

As BOPIS Reaches its Status as a Competitive Retail Staple, Effective BORIS is the Next Step

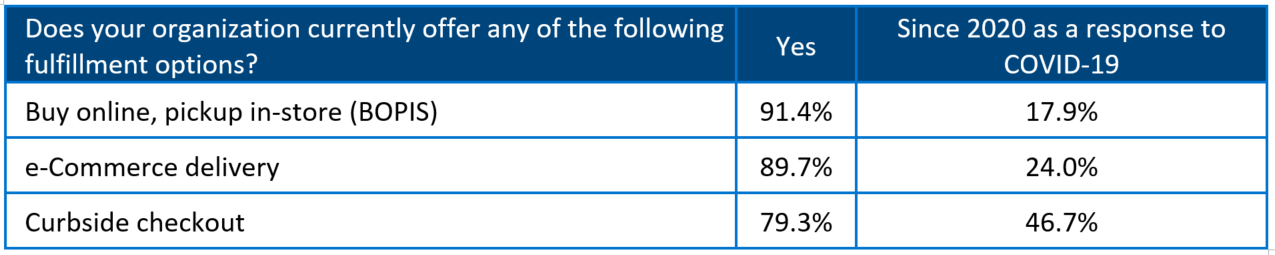

As supported by VDC Research’s 2021 Contactless Engagement and the New Retail survey, which was fielded as on online questionnaire to decision makers and stakeholders with leadership positions across predominantly North American-based large retail organizations that have customer-facing locations, omni-channel fulfillment models are now a competitively necessary norm. This is especially true of buy online, pick up in-store (BOPIS) options, of which 91.4% of survey respondents claim their retail organizations currently support.

“If a retailer doesn’t have BOPIS and curbside by now, it makes them looks ancient. You can equate it

to touchless pay – it gives the impression that your business is modern and caught up if you offer it.”

– Director of Web Services, end-to-end retail commerce software provider

e-Commerce delivery and curbside checkout are supported by 89.7% and 79.3% of large retailers respectively, but curbside checkout in particular has had the most significant jump in adoption by businesses over the last year or so as a direct response to the disruption caused by COVID-19 (Figure 1). The nature of curbside checkout being largely rolled out in response to the pandemic puts to question its staying power beyond the reactive impact that COVID-19 has had on shopping behavior, at least compared to recent rates that it has been offered and used. BOPIS and e-commerce delivery already have more longstanding footprints, and they appear to be poised as competitive staples for the average retailer moving forward as well.

Figure 1: Does your organization currently offer any of the following fulfillment options?

With BOPIS models established and here to stay, it is with optimized buy online, return in-store (BORIS) processes that retailers will stay ahead of their peers and enhance their returns on omni-channel infrastructure and technology investments. A recent article in The Atlantic highlights an important value proposition of BORIS for retailers, explaining that “by one estimate, every return [via shipping] costs a retailer an average of $10 to $20.” Beyond this cost burden, the article extrapolates on the stakes of BORIS even further, stating that online orders were returned at a shocking rate of 70% amid the pandemic.

For a retailer to juggle the need to invest in and expand omni-channel fulfillment models, the negative impacts of an economy and shopping habits stricken by a pandemic, and then the cost-inefficiencies of exploding online return rates, the bottom line impact can be devastating. As a response to the latter element, though, BORIS offers both the chance for dissatisfied customers to resolve their unwanted purchases more quickly and allows retailers to save on the logistical costs associated with shipping and receiving returns.

Retailers are fully aware of the advantages of an efficient BORIS operation. Across those currently offering both BOPIS and BORIS, respondents of VDC’s Contactless Engagement and the New Retail survey generally share specific points of satisfaction for BORIS investments that line up with and rank in a similar order to their sentiments regarding BOPIS investments. Importantly, though, retailers are extremely satisfied with the ‘impact on their organization’s profitability’ and ‘competitive differentiation’ benefits that BORIS offers at rates of about 4 percentage points higher for each than they are compared to their BOPIS investments. That gives these two elements – profitability and competitive differentiation – the largest perceived advantage of BORIS compared to BOPIS, and highlights the value of BORIS adoption as the next competitive step for retailers. For more on the retail landscape and the technology and market dynamics influencing the industry’s stakeholders, look out for VDC’s upcoming report, The New Retail: BOPIS, Curbside Checkout and Contactless Engagement: How COVID-19 Disrupted the Retail Experience.

Download the executive brief of that report here, or reach out to info@vdcresearch.com for any questions or requests regarding this research.