IoT & Embedded Technology Blog

Securing the Road Ahead: Self-Driving Cars & Cybersecurity

by Joe Abajian & Dan Mandell | 1/3/2024

By nature, autonomous cars amplify cybersecurity stakes. If hackers compromise a self-driving car’s internal computing network, its safety critical components (brakes, gas, transmission, headlights, etc.) can become exposed. Fully automated fleets will be prime targets for ransomware hacks. In the future, crucial freight and trucking infrastructure will depend on automated systems.

Cybersecurity needs will advance with autonomous driving capabilities. Level 1 autonomous driving (ADAS features such as electronic lane keep assist, adaptive cruise control, parking assistance, etc.) presents the least cybersecurity risk. Level 2 and Level 3 autonomous driving, the highest levels of autonomous driving publicly available (self-driving with varying levels of human monitoring required), pose significant cybersecurity stakes. To support and secure higher levels of autonomous driving, OEMs will demand strong intrusion detection and prevention systems (IDPS), active monitoring services, and timely over-the-air (OTA) update support.

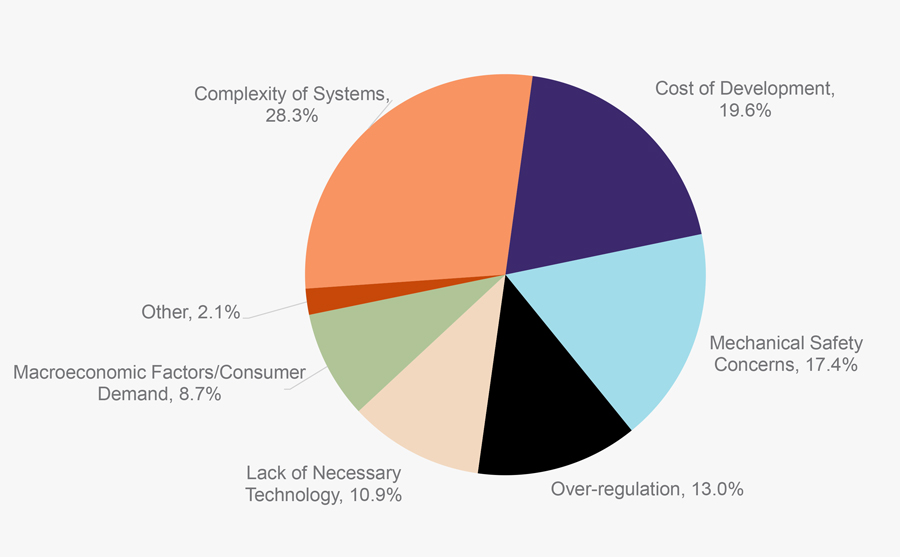

It’s worth noting, however, that widespread adoption and development of autonomous driving technology faces significant obstacles. Out of the 55 automotive engineers that participated in VDC’s Voice of the Engineer survey, 28.3% of respondents identified complexity of systems as the biggest obstacle to autonomous vehicle development, suggesting that higher levels of autonomous driving won’t become widely available for several years. Concerns around cost of development (19.6% of respondents) suggest that the market for autonomous driving will continue to be led by luxury automakers, although all major automotive groups are making investments in autonomous driving technology. Varying with implementation timelines, nearly all automakers will require cybersecurity support for autonomous driving technology.

Biggest Obstacle to the Development and Growth

of the Autonomous Vehicle Industry

(Percentage of Respondents)

Despite these potential benefits, developing on cloud-hosted hardware does not come without its considerations. Communication between device components and the execution of software may not mirror that performed once physical hardware is introduced, resulting in latency complications for certain time-sensitive, real-time response use cases. Further complications may arise as standards and regulations begin to catch up to these offerings from the commercial market, particularly among safety-critical markets sensitive to security.

One such example released in October 2021 comes from British semiconductor design firm Arm (NASDAQ: ARM). Through its Arm Virtual Hardware (AVH) solution, the company offers IoT developers access to virtual, cloud-native versions of its Corstone and Cortex-M processors. Other vendors including Intel (NASDAQ: INTC) and Texas Instruments (NASDAQ: TXN) offer capabilities for cloud-native access to their portfolios of hardware products at varied stages of commercial readiness.

Other companies are also working on transitioning their portfolios towards addressing this market demand. Japan-based semiconductor manufacturer Renesas Electronics (TYO: 6723) is planning for the Q1 2024 release of a cloud-native solution that will provide automotive engineers with a virtual environment for developing, debugging, and evaluating application software. Through this solution, developers will gain access to virtual forms of Renesas’ next-gen system-on-chip (SoC) and microcontroller unit (MCU) hardware far before access to commercial or even prototype versions of these devices is available.

To learn more about the growing market for development solutions in the cloud and the vendors that are leading the charge, check out VDC’s upcoming report, Cloud-native IoT Development Solutions.