Enterprise Mobility & the Connected Worker Blog

Parcel Delivery Volumes Drop, Forcing E-Commerce & Delivery Leaders to Re-strategize

Parcel shipping leaders FedEx and UPS have had to temper volume expectations for 2023 after a drop in Q2 revenues. FedEx, which reported a 10% revenue dip year over year, noted that the trend was felt across the industry, and that it would focus on consolidation and operating cost reduction to mitigate the drop. UPS, down 10.9% in Q2, is focused on winning back business and securing new opportunities. USPS reported a decline of 2.4% in year-on-year revenues, while Amazon logistics reported 5.5% growth.

Q2 YOY Shipping Revenue Changes Across Top US Parcel Shippers (Millions of Dollars)

| Company | Q2 2022 | Q3 2022 | % change |

| FedEx | $24,394 | $21,930 | -10.1% |

| USPS | $18,741 | $18,573 | -0.9% |

| UPS | $24,766 | $22,055 | -10.9% |

| Amazon (shipping costs) | $19,304 | $20,418 | +5.5% |

| Top 4 Total | $87,205 | $82,976 | -4.8% |

Data sourced from company earnings calls.

A downward trend in parcel shipping can be attributed to multiple factors: the COVID-induced spike in online purchasing persisted longer than anticipated and is just starting to attenuate across industries as shoppers return to pre-Covid in-store shopping levels. Continued talk of recession in the US and increased cost of living has put pressure on consumer spending, discouraging shoppers from e-commerce impulse purchases or subscription orders that may have costlier shipping than in-store alternatives. Current census data points to non-automotive e-commerce hovering at levels forecasted from stable 2018-19 growth, in other words, not the continued exponential growth seen during 2020-22.

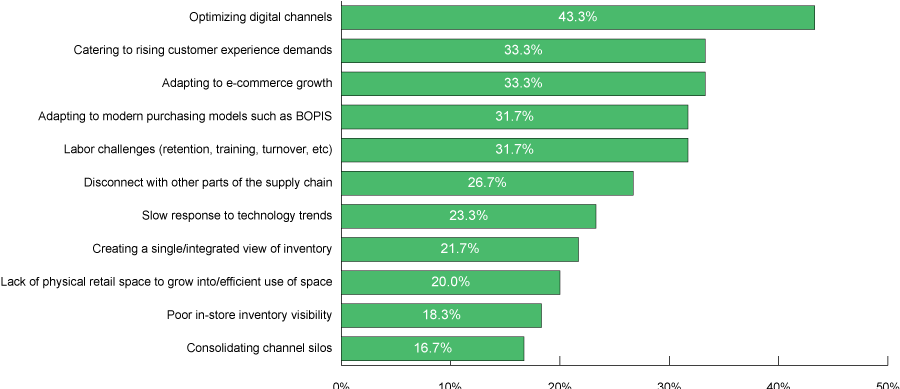

What would you say are the most significant obstacles facing retail operations in general?

Source: VDC Buyer Behavior Guide (2022)

New realities in parcel shipping are likely to have ripple effects in retail operations. VDC’s 2022 Buyer Behavior Guide found that optimizing digital channels and adapting to e-commerce growth were both top priorities of enterprise mobility leaders in the retail sector. As e-commerce growth stabilizes, retail operations’ focus is likely to shift to other pressing issues like labor challenges, in-store technologies, and sourcing. Retailers that are seeing a decline in omnichannel demand will also shift their technology investment toward in-store shopping features like digital kiosks, mobile POS, and self-checkout. Diminished need to liaise with fulfillment and delivery drivers has the potential to reduce traffic for omnichannel software and e-commerce delivery app downloads.

In e-commerce warehousing, operations leaders will need to think quickly to salvage profits. The quick commerce market has seen massive consolidation and continued failure since VDC’s Q-commerce Report last fall, demonstrating that consolidation and optimization efforts were not enough to weather declining demand and consistent negative margin. Considering the slim supply of workers for the industry, operations leaders will seek ways to optimize, although full automation will be a high investment for limited budgets. Enhancing workflow capabilities of current staff is a likely strategy: e-commerce will concentrate investments on inventory counting automation (warehouse drones/advanced image capture) and improved ergonomics for order fulfillment (wearables).

Transportation has seen a general dip in YoY volumes in Q2. Larger shifts in the industry, such as the dissolution of trucking giant Yellow and less backlog to work through than during the same period in 2022 are likely contributing to the decline. The historic contract resolution between UPS and the Teamsters Union bodes well for mobile workers in trucking and delivery, who have won improved protections around hours, work environment, and pay. Enterprise leaders in parcel delivery are likely to make new investments in fleet management and in-vehicle hardware as they work to advance the capabilities of a limited cohort of drivers.

Curious how other enterprise mobility leaders are navigating labor and market uncertainties? VDC’s Buyer Behavior Guide examines technology trends across seven industries. See VDC’s 2022 Guide for more information. The 2023 Guide will be released in Q4 2023.