Enterprise Mobility & the Connected Worker Blog

Starlink: The New Space Race is Satellite Networks

by Rowan Litter | 04/01/2021

Each day, the world becomes more and more connected. People and businesses increasingly rely on technology to communicate and share information. However, there are still parts of the world with underserved or unserved access to the Internet; according to Datareportal.com, only 59.5% of the global population has network access as of January 2021. Most of the regions that lack connectivity are in rural geographies. With the emergence and rollout of 5G technologies, governments, mobile network operators (MNOs) and other network enablers are working to improve network access and quality of access to these regions. In the United States alone, the Federal Communications Commission (FCC) approved the commercialization of the Citizens Broadband Radio Service (CBRS) spectrum band to connect rural America. Connecting these regions means millions of potential customers for network providers, but standard market business models might not be the most effective.

Traditionally, ventures by companies to provide reliable broadband access via satellites have fallen short, primarily due to the cost of manufacturing satellites and launching them into space. There are multiple orbital levels in which satellites can be launched and each level has certain uses. Middle-Earth Orbit (MEO) satellites are common for GPS use. The type of satellites that enable data communication and network access are Low Earth Orbit (LEO) satellites. These satellites orbit from 160 to 2,000 kilometers from the earth and can provide coverage to only a small area, so massive amounts of them are needed for global coverage, referred to as ‘mega constellations.’ Over the past several decades, the demand for connectivity has increased, the cost of deploying satellites has fallen significantly and manufacturing these satellites has become much more efficient. As a result, several companies are attempting to provide fast speeds, low latencies and competitive prices to customers by sending mega constellations of satellites into LEO.

The company leading this new space race is Starlink, a division of SpaceX. The FCC subsidized the company with just under $900 million last year to bring broadband coverage to rural America in 35 states. Starlink has already launched over 1,200 of the 11,943 satellites that are approved to be deployed for a complete ‘mega constellation.’ The efficiency of these rollouts are even more impressive, as the company is manufacturing about 120 satellites a month. Regardless of location, Starlink’s ‘Better than Nothing’ beta program has over 10,000 users and some of these users have already noted latency below 31ms. The company was also touting download speeds of 1Gbps, and has since raised their goal to 10Gbps. SpaceX wants to disrupt the over $1.5 trillion global telecommunications market, and other companies are starting to pursue similar ventures; Amazon was also approved by the FCC to launch its own satellite Internet service, known as the Kuiper Project, into LEO.

Not only is there opportunity for connecting consumers through satellite coverage, but also enterprises, especially those located in rural areas. Possible industries for adoption of these services include: remote manufacturing factories, warehouses, utilities, oil and gas facilities, and transportation hubs, including ground, air and maritime transports. Current wireless networks are land-based and lack the infrastructure/capability to provide reliable coverage for ships traveling across expansive open waters. Satellite coverage can fill in these gaps and enable advanced technologies, such as fast communications, autonomous transport and signaling/navigation.

In many industries, satellites can provide support for IoT device networks and systems that use machine-to-machine communication. Use cases include smart grids and metering, remote maintenance, smart factories and supply chain applications. Notably in transportation and logistics enterprises, satellite communication can be used for asset management capabilities such as fleet tracking and supply chain management.

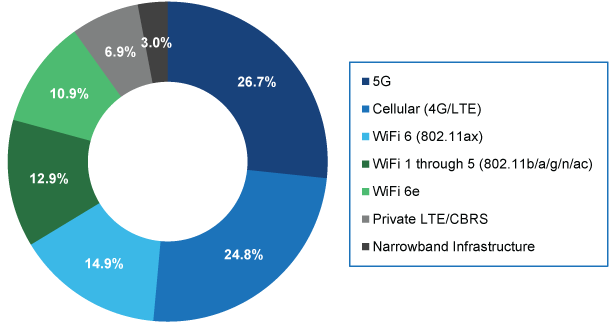

Although there is potential for satellites to cause serious disruption in the telecommunications market, the advancements being made with 5G and WiFi 6 and 6e will make it difficult for enterprises to consider an entirely new network deployment type. In VDC Research's 2020 Enterprise Mobility Buyer Behavior Guide decision makers across various industry verticals indicated their plans to connect to networks over the next 12 to 24 months. Over a quarter of field service organizations stated that they plan to deploy 5G networks over this time period. Many of the well-established network providers are already going through innovations to provide coverage in unserved and underserved regions. New satellite players will have to address many uncertainties such as satellite lifecycle management, network reliability, and fee/subscription models for customers.

Field Service: Considering the wireless connectivity requirements of your frontline mobile workforce over the next 12 to 24 months, how will their mobile device primarily connect?

However, coverage is not the strongest aspect of 5G and satellites can fill in the gaps, acting as a potential option for 5G network backhaul. As Starlink starts to see real adoption towards the end of 2021, we will see the true benefits and shortfalls of LEO satellite connectivity. If successful, we expect the company, and competitors such as Amazon, to extend coverage globally, starting in rural regions like the Arctic. If unsuccessful, then the New Space Race will have been short and the wave of cellular wireless networks will continue on its journey to connect the world. For more of the Enterprise Mobility team’s coverage of wireless networks, check out VDC’s recently published Private LTE in the Enterprise report or download the full WiFi 6E & Private LTE: What they are and Why They are Important VDC View now.

For further insight on the year ahead, download our 2021 Enterprise Mobility & AIDC Predictions piece today.