Enterprise Mobility & the Connected Worker Blog

A New Year, a New Administration, and New Enterprise Mobility Dynamics to Consider

by Pat Nolan, and Chris Paggioli | 03/26/2021

As 2021 gets underway and we look ahead to the next year, and even the next four years, there are new enterprise mobility market factors to expect in the wake of the new presidential administration in the United States. Although the Biden administration only took the reins in January, it has outlined many technology-focused polices and priorities both throughout the campaign trail and in its early days in office. Many items on Biden’s technology to-do list – such as addressing the monopolization of consumer technology segments and revisiting online speech responsibilities and regulations – tackle Big Tech in ways that are most consequential to organizations like Google, Facebook, Amazon and Apple, and the billions of people that use their consumer-facing platforms. Still, other commitments are likely to have positive repercussions on key enterprise mobility markets.

According to ITIF (the Information Technology & Innovation Foundation), an independent nonprofit dedicated to the intersection of public policy and technological innovation, the new administration has prioritized narrowing the digital divide that has been fostered by inadequate Internet access and affordability across the country – a divide that is now amplified by the pandemic’s at-home working and learning requirements. Moreover, Biden’s agenda includes a proposed economic stimulus package focused on job creation and infrastructure that would put hundreds of billions of dollars into clean energy projects and infrastructure. The Biden administration’s massive clean energy plans, as well as its “universal broadband” ambitions, would necessitate substantial infrastructure projects, and as a result, heavily expanded mobile workforces to build and support them. ITIF also anticipates increased public funding for domestic and advanced production and R&D.

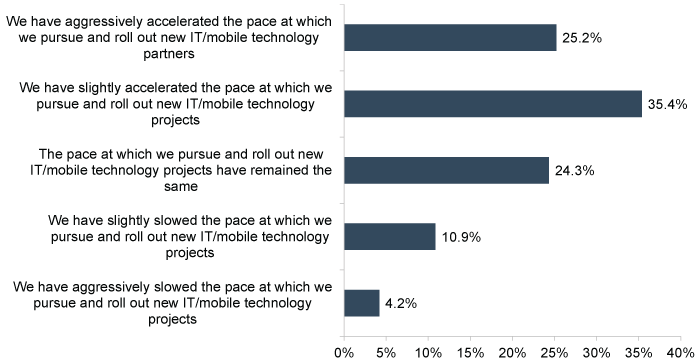

All of these plans entail an influx in spending that will grow the number and size of various frontline workforces operating across the country to execute them, and these workforces will need enhanced mobile solutions and assets to ensure productive and effective workflow execution. According to VDC’s recently published Enterprise Buyer Behavior Guide, most organizations across all industries have responded to COVID-19 by accelerating the pace at which they pursue and roll out new IT and mobile technologies (Exhibit 1) even though 2020 revenues were, on average, 11.1% lower than projected before the pandemic hit. With some of the new administration’s economic stimulus efforts directly targeting some of key industries, it is likely that these organization’s mobile technology investments will be accelerated even further.

At the B2B level, the digital divide is a real competitive threat. Many enterprise operations still use manual processes while some of their competitors are on their third or fourth generation of deployed mobile technology solutions. Over the last year, the pressures and demands of COVID-19 on many organizations and industries have amplified this competitive threat and, as a result, have served as a catalyst for mobile and digital investments even before a surge in government spending on infrastructure and production is expected to provide a bump in opportunity for many manufacturing, supply chain, utilities and other industrial operations.

For further insight on the year ahead, download our 2021 Enterprise Mobility & AIDC Predictions piece today.