| |

FOR IMMEDIATE RELEASE

Contact:

Eugene Won

Senior Director of Marketing & Client Services

VDC Research

(508) 653-9000, ext.122

ewon@vdcresearch.com

Global Market for Mobile Thermal Printers to Exceed $500M by 2021, According to VDC Research

Brand differentiation through R&D initiatives key to capturing greater market share

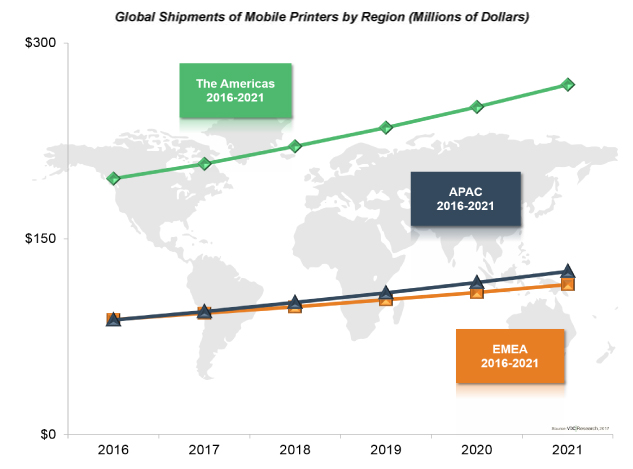

NATICK, MA | September 21, 2017 - The global mobile thermal printer market is expected to generate more than $500M in revenues via product sales by 2021, according to a new report by VDC Research (click here to learn more). The Americas is the biggest market for mobile printer solutions by global revenue share, accounting for 54% of global market revenues in 2016 followed by Europe, Middle East, and Africa (EMEA) where logistics and retail segments present growth opportunities. In Asia-Pacific, both local and foreign vendors continue to benefit from strong year-over-year growth in the region as enterprises and SMBs aggressively adopt mobile solutions to support their workers’ every day workflows. However, challenges in the form of price competition, varying product requirements, and a fragmented distribution landscape will make it a difficult environment in which to operate.

The retail, transportation & logistics segments continue to be the main markets for mobile printing solutions with omnichannel and e-commerce related trends driving demand and purchases of mobile printer products to support cross-channel fulfillment, click-and-collect, online retailing, logistics services, and inventory management within and outside of the four walls. “E-commerce sales boom, retailer adoption of omnichannel operating models, and greater organizational focus on automation of once paper-based methods in verticals such as commercial services, government and health care, will drive demand and investments in mobile printers, ” said Shahroze Husain, Research Analyst at VDC.

The highly fragmented nature of the competitive landscape for mobile printers serves to highlight the immense opportunity it presents across regions and verticals. Market leaders Honeywell and Zebra Technologies face stiff competition from Asia-based vendors including Bixolon, Fujitsu Components, and SATO that have continued to see strong growth year over year. Vendors have proactively introduced new and differentiated solutions to their portfolios with an aim to address gaps and grow their share of revenues and profits in this competitive marketplace. Channel partner engagement with value-added resellers, systems integrators, and independent software vendors (ISVs) via partner programs have become a vital tool in order for vendors to reach new markets and improve run-rate sales. “Developing Independent Software Vendor (ISV) networks is now a requirement, to help expand their market shares and brand awareness by developing mobile applications for the latest generation of smart devices with which these mobile printers often communicate,” said Husain.

Click here for more information on this research.

About VDC Research

Founded in 1971, VDC Research provides in-depth insights to technology vendors, end users, and investors across the globe. As a market research and consulting firm, VDC’s coverage of AutoID, enterprise mobility, industrial automation, and IoT and embedded technologies is among the most advanced in the industry, helping our clients make critical decisions with confidence. Offering syndicated reports and custom consultation, our methodologies consistently provide accurate forecasts and unmatched thought leadership for deeply technical markets. Located in Natick, Massachusetts, VDC prides itself on its close personal relationships with clients, delivering an attention to detail and a unique perspective that is second to none.

###

|

|