| |

FOR IMMEDIATE RELEASE

Contact:

Neha Narula

Senior Digital Marketing Associate

VDC Research

(508) 653-9000, ext.128

nnarula@vdcresearch.com

Stationary Point of Sale Scanner Market to reach $480M by 2023, According to VDC Research

Retailers are upgrading their bioptic and presentation units to streamline operations

NATICK, MA | December 13, 2019 - The market for stationary point of sale (POS) scanners experienced an unprecedented global growth rate in 2018 and will reach $480M by 2023, according to new research from VDC (click here for more information). The need to utilize 2D barcodes at the point of sale has driven retailers to upgrade their fixed scanners, especially bioptic and presentation units, in order to streamline operations and integrate omni-channels.

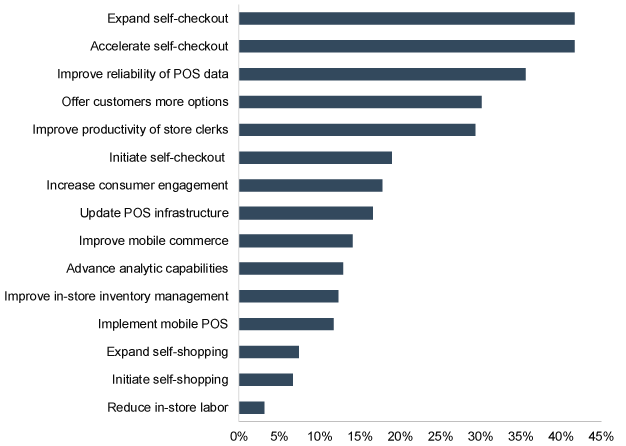

“While only around 10% to 15% of transactions occur online, the online component of retail sales is critical,” said Andy Adelson, Senior Research Analyst of AutoID and Data Capture at VDC. “Consumers expect a seamless flow between physical and online shopping, and as a result, retailers are increasing their investments in stationary POS technologies to optimize their omni-channels.” Changing consumer expectations are also propelling POS scanner growth; the report explains that while the frenzy of in-store frictionless as exhibited in Amazon Go stores has slowed, it successfully shifted consumers’ shopping preferences towards faster and more convenient checkout. Retailers are heavily investing in POS systems to provide self-checkout, buy online and pick up in store, and more options to improve the customer journey.

Leading POS Investment Goals for 2021

Although VDC predicts slowing market growth in the near-term due to pricing pressures and shifts in technology mix, the long-term outlook presents sustained growth for stationary POS systems for more than 5 years. The report shows that the industry’s growth hinges on adoption of 2D scanning technologies at the point of sale in all stationary POS form factors. “Approximately three-quarters of retailers over the next five years will invest in technology that can read two dimensional symbologies, such as QR codes and DataMatrix,” said Adelson. By 2023, the installed base of 2D scanning will be 70% as the market slowly retires its 1D technology. Additionally, OEMs are improving scanning technology to accommodate scans of mobile phones, coupons, ID cards, and more, with increasingly challenging conditions such as variable lighting.

Aside from 1D and 2D barcodes, retailers and solution providers are actively evaluating other options such as Digimarc’s invisible barcode and machine vision for digital image recognition. However, these alternatives face their own significant technological and financial challenges which will largely restrict their implementation over the next five years. “As brick-and-mortar retailers contend with ever-evolving technology needs and consumer preferences, they must do all they can to improve customer service and engagement in order to remain competitive against e-commerce giants,” explained Adelson.

Click here to learn more.

About VDC Research

VDC Research provides in-depth insights to technology vendors, end users, and investors across the globe. Offering syndicated reports and custom consultations, VDC’s market research coverage of AutoID & Data Capture, Enterprise Mobility & Connected Devices, Industrial Automation & Sensors, and IoT & Embedded Technologies is among the most advanced in the industry, helping clients make critical decisions with confidence. VDC’s methodologies consistently provide accurate forecasts and unmatched thought leadership for deeply technical markets.

###

|

|