IoT & Embedded Technology Blog

NXP and Freescale: A Genuine Marriage

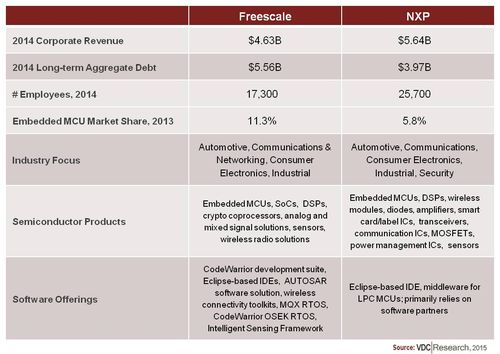

NXP’s acquisition of Freescale to form a $40B company is much more than two organizations unifying under a common banner – it is the wedding of leading embedded technology suppliers with similar, yet different, market focus and goals. Both companies provide a rich mix of embedded processors, analog and mixed signal solutions, wireless ICs, and other hardware. While there is some overlap in the companies’ microcontroller, RF, and sensor products, the rest of Freescale and NXP’s offerings are hugely complimentary to each other with cross-selling opportunities in a variety of markets including automotive, consumer electronics, and industrial automation.

While the acquisition is not a revolutionary change in direction for NXP and its target verticals, the new combined company will feature a much broader software portfolio, new products, and much greater corporate size that will enable it to compete more effectively with other semiconductor juggernauts and align with growing user requirements for facilitating development of the software stack.

Freescale has carried strong corporate momentum over the last few years as a result of its aggressive push into the Internet of Things (IoT) and investments made facilitating software development for embedded engineers. Freescale supports a variety of software development tools and environments in addition to providing the free MQX real-time operating system (RTOS) and its commercial CodeWarrior OSEK RTOS. Freescale also provides a variety of software libraries, frameworks, protocol stacks, and more. NXP, on the other hand, has done very little to facilitate software development on its MCUs and other hardware products or to supply crucial components of the software stack – instead relying heavily on its software partners for support. Embedded software has been vital to Freescale’s embedded processor market share growth and differentiation.

The acquisition of Freescale propelled NXP to become the second-largest supplier of embedded MCUs in addition to now being a leading vendor of SoCs as well. The combined assets and offerings of Freescale and NXP will also enable the company to better compete with its rival in the embedded processors space, Renesas. While there are a lot of similarities between Freescale and NXP, the general disruption of a massive merger such as this will certainly challenge the steady revenue growth enjoyed by both companies during the past three years. Nonetheless, the combined company expects to be able to shed hundreds of millions of dollars each year as a result of expanded buying power and annual cost synergies.

One of the new vertical opportunities for NXP produced by the merger is in the communications and networking space for applications such as gateways, small cell base stations, SDN switches/routers, and network attached storage with the QuorIQ platforms and PowerQUICC communications processors. While the company could divest this particular business to maintain its focus on other industries, VDC believes NXP should maintain Freescale’s communications and networking processor lines to take advantage of the rampant growth expected in that space through 2018 (5-year revenue CAGR of 10.8%) caused by the growing strain on network operators and service providers due to pervasive mobile computing and the IoT.

The proposed merger (expected to close in 2H 2015) is hugely beneficial for both companies. For Freescale, the acquisition means being able to shed some of the lingering restrictions from its long-term corporate debt issues. For NXP, it’s an opportunity to become a much broader provider of embedded technology with higher margin products. The move also greatly bolsters its software support which is becoming increasingly important to embedded hardware value every year. It will be imperative that NXP continues to develop and build its investments in enabling software and tooling support to ensure a lasting, beneficial marriage of the company’s traditional and new businesses, products, and solutions.

View the 2017 IoT & Embedded Technology Research Outline to learn more.