IoT & Embedded Technology Blog

IoT Forcing Embedded Boards and Systems Vendors to Adapt to Survive

Emerging embedded hardware requirements are stirring up competition for motherboards and integrated systems while driving demand for more IoT-related systems integration services.

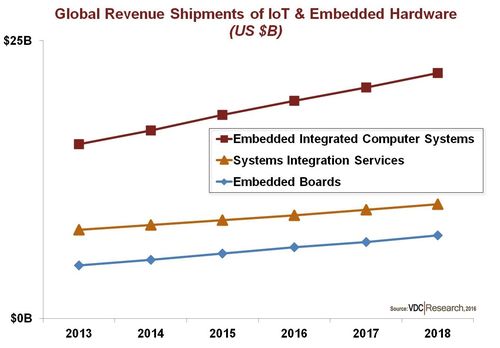

The global markets for embedded boards and integrated computer systems will see growing competition over the next five years, according to a new report by VDC Research (click here to learn more). The embedded hardware space is vast, continually evolving, and extremely fragmented with larger organizations often supplying several different board and/or system form factors as well as potentially a variety of SKUs featuring different configurations thereof. Systems integration services, in turn, are benefiting from the growing complexity of modern (connected) embedded systems and are seeing greater use for IoT designs.

“Complacency now will seriously hamstring the long-term development and growth potential for all embedded hardware players,” says VDC analyst Daniel Mandell. “Ramping requirements for processing performance, footprint, and scalability are forcing embedded hardware suppliers to adapt and adopt to new product form factors such as MicroATX, VPX, and xITX. Some more mature hardware form factors like ATCA will continue to see slight growth through the next five years, though new organic revenue generating opportunities for incumbent suppliers will be scarce and increasingly challenged by alternative architectures.”

For small-form-factor embedded systems, computer-on-modules (COMs) have emerged as a convenient solution for enabling cost-effective hardware flexibility. While a variety of COM standards have fragmented the market, some form factors such as COM Express and Qseven are expected to see strong market growth. Kontron is the longstanding frontrunner of the embedded COMs space, having pioneered the concept. Unlike COMs, the global market for PC/104 family modules is expected to remain relatively stagnant through the next five years as suppliers look to adopt newer and more heterogeneous form factors like EPIC.

The market share leaders for embedded integrated systems have focused their recent acquisitions and collaborations on facilitating software development and enabling broader industry application support. The potential acquisition of EMC Corporation by Dell could produce a new leader in the embedded integrated systems market. HP Enterprise has made some dramatic acquisitions in 2015 to expand its portfolio of LAN offerings and help its customers transition to hybrid cloud environments. To remain competitive with new and traditional market players, embedded systems suppliers must bolster their support and development offerings for more of the solution stack.

View the 2017 IoT & Embedded Technology Research Outline to learn more.