Enterprise Mobility & the Connected Worker Blog

How Microsoft can Gain Relevance in Enterprise Mobility

Microsoft has had fits and starts since releasing its first modern mobile OS in Windows Phone 7.

Microsoft has long been aware that mobile enablement has taken root within its customer base. While Microsoft has had the opportunity to leverage its cloud and software development capabilities and position them for the future, the company has struggled, and has seen little traction for its enterprise mobility related solutions. Since establishing its Enterprise Client & Mobility (ECM) team, Microsoft has been able to incorporate a broad portfolio of assets and products, namely: Windows Server, System Center, Microsoft Azure, Office 365, Microsoft Azure RemoteApp, Active Directory, Azure Active Directory, Remote Desktop Services, and security. Though small, the ECM team has quickly become a key pillar of Nadella’s vision for a Mobile-First, Cloud-First focus. The team has been working hard on elevating the messaging around Microsoft’s Enterprise Mobility Suite (EMS), which has Microsoft Azure AD Premium, Azure Rights Management Services (RMS), and Microsoft Intune at its core. The key will be to deliver on the value proposition that Microsoft has been leading with around its EMS suite — one vendor, one contract, one SKU.

Simplifying the EMM Procurement Process is Difficult

Microsoft’s messaging for its EMS suite is spot on. The company has correctly identified a major pain point that has historically plagued IT decision makers — licensing, contracts, and renewals. To compete and succeed, Microsoft must continue to work on educating its channel on the value play it has assembled in EMS as it has the right solution components in place for success. Microsoft has put together bundled pricing for EMS, which makes the product attractive for channel partners (at $7.50 per user/per month, EMS is aggressively priced — roughly half of what it would cost to acquire, Intune, Azure AD Premium & RMS separately. The company also plans to add Advanced Threat Analytics to its EMS suite in Q3 (via the technology it acquired from Aorata in Q4 of last year).

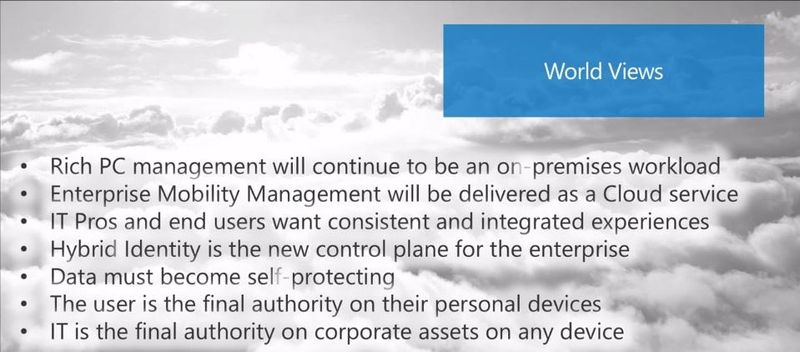

Microsoft has the right vision going forward (see below), but executing on it could prove challenging due to the intensifying competition in the market. Prominent EMM vendors such as AirWatch, Good, MobileIron, and SOTI have worked hard at streamlining and simplifying their pricing plans. Additionally, these vendors are working well with the mobile ecosystem as it evolves (for example every prominent mobile-first EMM vendors has integrated with Google’s Android for Work program [with the exception of Good]. Integrating with this program is critical to provide enterprise security for Android deployments going forward (there are alternatives such as Samsung’s Knox that provide the requisite containerization that is core to the Android for Work program, but even Samsung is now begun to support the program itself). Microsoft chosen not to participate in the program for very deliberate reasons — it wants to leverage the built-in MDM functionality it offers with Office 365 to lure customers away from their existing vendor. This makes sense, as Microsoft has chosen to not permit third-party integration with competing EMM vendors to its Office applications and doesn’t support standard iOS and Android APIs for its applications.

Easy Migration Provides an Opportunity

While many of Microsoft’s customers are likely to already be using a competing EMM vendors’ products, the migration process has also been streamlined; this has made it easy enough to switch over to Microsoft products (EMM vendors are still capitalizing on migrations away from BlackBerry’s platform). It seems as though customers are open to evaluating Microsoft’s EMS solutions as a means of consolidating disparate tools used to manage devices and applications. Identity is also being reevaluated as more companies mix cloud and on-premises software services. Intune does an adequate job in providing secure access to email and other Office 365 offerings on a wide-range of devices and operating systems. Azure RMS provides data protection, and hybrid Identity and Access Management (IAM) is anchored by Azure AD Premium, a service that nearly every company uses to authenticate its users. The emphasis on hybrid here it to highlight its importance of Microsoft's distinction of Hybrid Identity as the new "control plane." This is demonstrative of the company’s recognition of empowering mobile users on their device of choice while enabling IT with visibility into who is trying to access data and apps and providing a means of validating and authorizing the appropriate personnel.

Source: Microsoft

So What Does Success in Enterprise Mobility Look Like for Microsoft?

The firm’s recent restructuring (Nokia’s ex-CEO, Stephen Elop, along with Kirill Tatarinov, Eric Rudder and Mark Penn have been edged out of the company, and Terry Myerson has been elevated to lead the new Windows and Devices Group going forward) and the increasing emphasis on Windows 10 signals Microsoft’s desire to position itself as a cross-platform productivity solutions company and could potentially signify a de-emphasis of the company’s Windows Phone strategy. Instead, VDC expects that Microsoft will compete with its operating system and attract corporate interest through the OS’s ability to function across all Windows devices (computers, tablets, and phones). Indeed, Microsoft appears to be trying to make Windows 10 look and act more like iOS and Android and create an opportunity to port iOS and Android apps to the Windows 10 OS. If these apps are able to retain their look and feel, Microsoft may see more uptake with its Surface products.

Microsoft has made notable progress in augmenting and integrating its disparate product lines into a true enterprise-grade mobility management platform. However, the vendor has yet to prove it is making progress with real customers and needs to get some wins under its belt. Suffice it to say, Windows 10 will be a critical release for the company.

View the 2017 Enterprise Mobility & Connected Devices Research Outline to learn more.