Enterprise Mobility & the Connected Worker Blog

Acquiring Direct Store Delivery (DSD) Optimization

Within the past week, the NASDAQ and NYSE witnessed the announcement of two major acquisitions: Walgreens intends to buy Rite Aid for $17.2 billion and Snyder’s-Lance plans to buy Diamond Foods for $1.9 billion. Even though Walgreens and Snyder’s-Lance reside in different industry sectors, they both heavily rely on direct store delivery; Walgreens to keep their pharmacies well stocked, and Snyder’s-Lance to stock their retail partners.

Direct store delivery (DSD) is a system of selling and distributing a wide array of products in which the supplier delivers goods directly to the retail store, thus bypassing traditional distribution centers and warehouses. Workflow integration within the DSD processes is often extremely complex and typically involves products which have high consumer demand or shorter shelf-lives. Product lines which are regularly supported via DSD plans include baked goods, beverages, dairy products, ice cream, and other snack foods. Other industries that frequently use DSD processes include wholesale distribution, gas, and pharmaceuticals.

In recent years, a primary hurdle for the DSD community has been the increased demand placed on mobile devices coupled with the constant need to optimize the numerous moving parts involved in the DSD process. In a market space where spoiled, rotten, or out-of-stock goods directly impacts profits, employing mobile devices which are efficient and adaptable to the complex technological requirements of DSD applications is critical. As such, those engaged with DSD must constantly assess their mobility solutions in order to keep their delivery operations running at peak levels. A 2015 survey, conducted by VDC Research, found that three of the top five investment drivers are directly related to with the ideas of efficiency and adaptability. These drivers include reducing order times, reducing out-of-stocks, and providing faster decision-making capabilities.

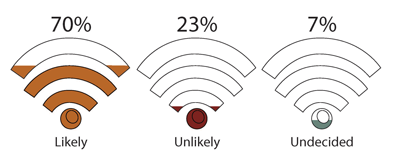

Likelihood of Migrating from Batch to Real-Time DSD Processing

The vast majority of the DSD market is only now catching up to the significant advances seen in mobile and wireless technology. Wireless coverage, performance, functionality, and cost of mobile devices are all factors which have drastically changed with little adoption into DSD systems Through advances in mobile technology, DSD suppliers can now communicate with their drivers and with retail partners regarding inventory, payment, and customer support services in real-time. Compared with aging batch-processing methods, WAN (cellular networks) connections or wireless DEX (Digital Exchange) support can significantly optimize every phase of the DSD structure. The modernization of DEX from a hardwired solution, which required DSD drivers to carry a fragile and unreliable DEX cable, to a wireless Bluetooth solution greatly improves transmission reliability and reduces errors during communication. A 2015 VDC Research survey revealed that DSD suppliers beginning to realize the opportunities presented by Bluetooth-based DEX and WAN. 70% of respondents indicated they are likely to migrate from batch processing to a real-time processing format within the next 2 years. With increased migration to real-time solutions seemingly imminent, VDC expects the next generation of DSD solutions to address performance gaps and better support CPG operations.

Even though Walgreens and Snyder’s-Lance populate opposite sides of the DSD chain, the effects of emergent, real-time mobile processing features will be apparent for both companies. They can expect to see more efficient customer support and faster response times to requests/inquiries. More specifically, Walgreens can leverage their expanded reach to better optimize existing DSD delivery strategies by modifying routes to better coincide with Rite Aid and Walgreens locations. Additionally, Snyder’s-Lance will be better positioned to react to real-time inventory information and will be able to consolidate Snyder’s products along with new Diamond products into the same DSD trucks and routes. Clearly, if Walgreens/Rite Aid and Snyder’s-Lance/Diamond take advantage of new mobile technologies described above, they should see more efficient services and reduction in overall DSD costs.

View the VDC DSD report to learn more.